The COVID-19 pandemic has not only been disrupting lives and corporations close to the earth for much more than a yr, but also the credit history ratings of huge corporations.

Company credit history rankings serve as a essential evaluate of creditworthiness, but also can ascertain borrowing prices. They assortment from AAA for prime-notch providers like Johnson & Johnson

JNJ,

and Microsoft Corp.

MSFT,

to D for defaulted firms.

Progressively, credit score rankings also can sign a likely path to restoration for industries challenging-strike by the prolonged general public-wellbeing disaster.

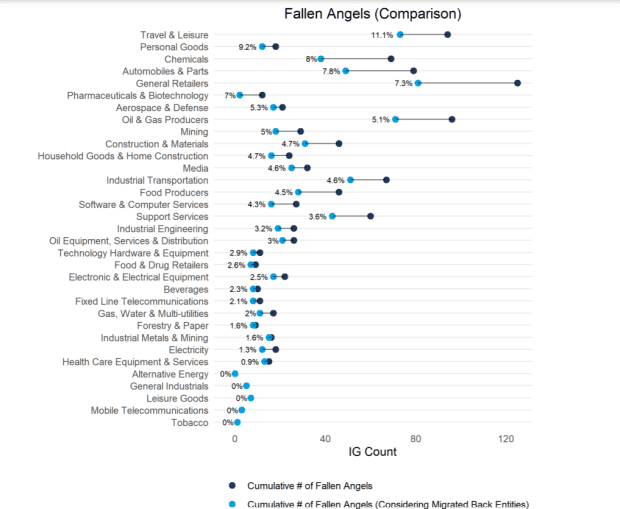

Acquire travel and leisure, a sector that observed fifty percent of all expense-grade corporations globally fall to higher-produce, or “junk,” position during the pandemic, in accordance to a new report from Credit rating Benchmark.

Even as components of Europe stay in a lockdown to have the coronavirus, journey and leisure has experienced the greatest share of “fallen angels” (at 11.1%) returning to financial commitment-grade status through the crisis, (see chart beneath).

Fallen angels, soaring stars

Credit history Benchmark

The report identified 1,051 fallen angels out of 6,895 corporations it sampled globally, or about 15% of the complete. It uncovered that about 5% migrated back again to expenditure-grade.

Retailers, oil and fuel, and the automobile and sections sectors also had been unstable on the credit-ratings entrance in the previous year, according to the report, with migrations concerning the two important brackets now a vital concentration for buyers.

Read: The future climbing stars of the debt entire world? Likely company fallen angels

Updates and downgrades can make a large change for a enterprise in phrases of its borrowing expenses. The regular generate on bonds issued by U.S. financial investment-quality corporations now sits in the 2.21% assortment, while it’s approximately double for those people in speculative-quality territory at about 4.21%.

All those premiums matter, especially in the previous yr as cruise companies, like Carnival Corp

CCL,

Royal Caribbean Group

RCL,

and Norwegian Cruise Line Holdings Ltd

NCLH,

have borrowed billions as their ships mostly have been idle.

See: White Household pushes again on cruise industry’s attempts to restart in July, as Florida sues Biden administration

But along with other “recovery” trades, shares of Carnival ended up up 31.9% calendar year to day Thursday, when people of Royal Caribbean and Norwegian were being up about 20%, in accordance to FactSet data.

That compares with the Dow Jones Industrial Average’s

DJIA,

get of 9.5% for the similar time period, although the S&P 500 index

SPX,

has superior 9.1%.