Although there is practically nothing “normal” about this year’s resort overall performance concentrations, the facts is showing a return to the regular seasonality that triggers lodge occupancy to ebb and circulation.

Photograph: STR

The info implies that the occupancy decline is owing mainly to seasonality affiliated with the reopening of in-particular person educational facilities across the state.

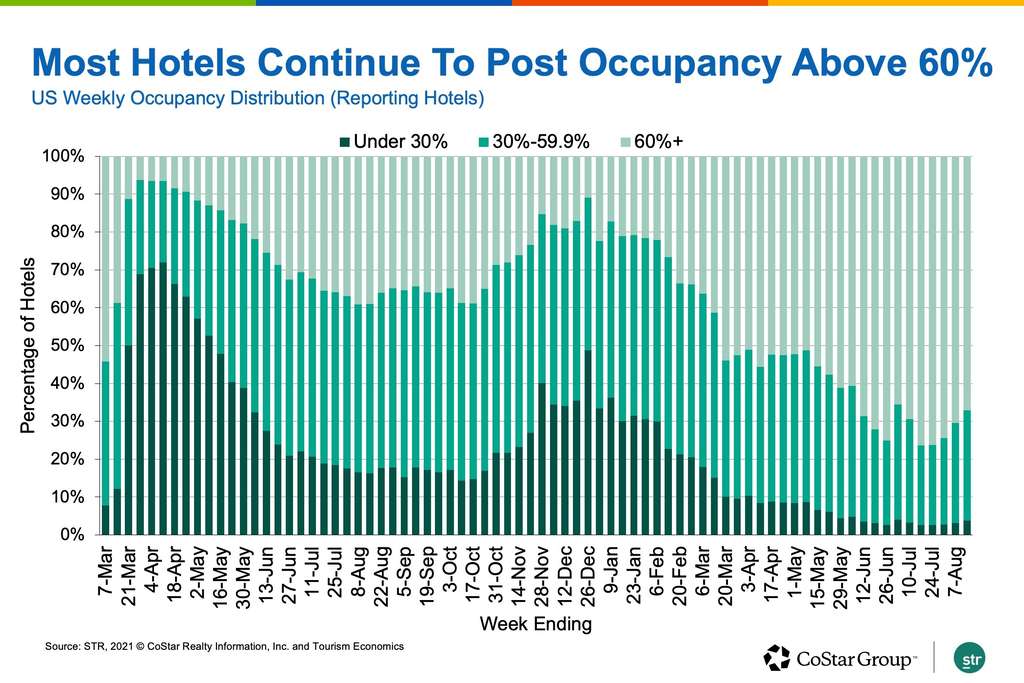

U.S. hotel occupancy declined for the 3rd straight week, but the index to 2019 has remained somewhat flat for the earlier 6 months, suggesting the return of seasonality.

Soaring conditions of COVID-19, mainly related to the Delta variant, also probably contributed to the decline in resort occupancy.

On a full-room-stock basis, which accounts for briefly shut hotels, weekly occupancy was 63.3%. At present, only 1% of U.S. hotel rooms — 64,000 — are closed, and just about 50 percent of all those closures are in just three cities: New York, Orlando and San Francisco.

Even with the fall in occupancy, 67% of all U.S. lodges noted occupancy larger than 60%, and of those people, a 3rd experienced occupancy higher than 80%. At the peak of summer time travel, 76% of resorts claimed occupancy over 60%, with 43% previously mentioned 80%.

Photo: STR

What is worrisome is the amount of decrease for large hotels — with 300 or additional rooms — in particular in STR’s major 25 markets.

All round, occupancy at large inns fell 4 factors to 55%, compared to 68% occupancy for all other accommodations.

In the top 25 markets, substantial resort occupancy lessened by five points. Big group hotels in the best 25 marketplaces skilled an even larger drop, with weekly occupancy down 6 points to 52%. In those main markets, 64% of big team resorts noted occupancy beneath 60% and the remaining 36% posted occupancy higher than 60%. All through the similar week in 2019, 82% of large team motels in leading 25 markets had occupancy above 60%.

As was documented at the Resort Information Conference, team lodges accounted for 40% of the industry’s income drop in the 2nd quarter, with large group accommodations in the best 25 accounting for 28% of the reduction.

Weekly lodge demand also declined for the third consecutive 7 days, but the index to 2019 was only .1 details lower than in the preceding week.

For the 7 days ending Aug. 14, 25 million lodge place nights had been sold — an ordinary of 3.6 million rooms every single working day of the week. At the peak of summer months, 3.9 million rooms ended up sold on ordinary every single working day.

Resort charges, which have set all-time records through the summer time leisure travel season, dropped for a next straight week.

Typical day by day amount for the U.S. hotel business was 1.4% decrease than the past 7 days. Charges declined a little much more on the weekend than on weekdays.

Weekend ADR in the top 25 markets fell 4%, with the worst decline claimed by massive motels, where by ADR was down 6%. Total, ADR in the top 25 was down 2.6% week about week, as opposed to a drop of .8% for all other marketplaces mixed.

Full sector nominal ADR was 106% of what it was through the same 7 days in 2019 — a little superior than the preceding week, when industry ADR was 105% of the 2019 degree. Nominal field ADR has surpassed 2019 stages for the past seven months.

On an inflation-altered foundation, ADR has been at or earlier mentioned 2019 weekly amounts in four of the previous 7 weeks. On a market degree, 63% of marketplaces had authentic ADR over 2019 ranges, up from 60% in the previous 7 days.

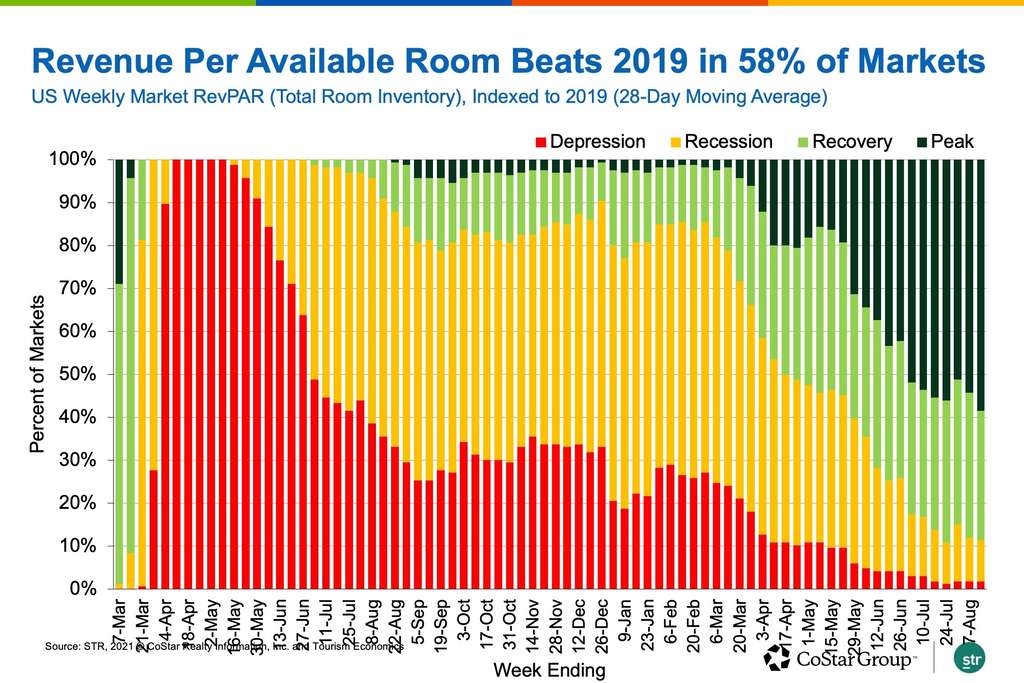

In accordance to STR’s Sector Recovery Keep an eye on — which compares the latest weekly general performance data from the similar 7 days of 2019 — overall space inventory RevPAR remained in “recovery,” with RevPAR among 80% and 100% of 2019 stages, for the 10th straight 7 days.

Photo: STR

Irrespective of the occupancy minimize, and accounting for inflation, the index rose a bit.

On a 28-working day going normal, 58% of U.S. marketplaces experienced “peak” nominal RevPAR — bigger than 100% of 2019 stages. That proportion is the maximum so far of the recovery. Major the index are motels in the Florida Keys.

Image: STR

Altered for inflation, 45% of marketplaces had “peak” RevPAR, which was also the maximum share to date.

On the flip facet, 19 marketplaces remained in “recession,” with RevPAR among 50% and 80% of 2019 ranges, or “depression,” with RevPAR significantly less than 50% of 2019 amounts. San Francisco proceeds to have the lowest index, with RevPAR at 41% of 2019 amounts.

Isaac Collazo is VP Analytics at STR.

This posting signifies an interpretation of data collected by CoStar’s hospitality analytics agency, STR. Be sure to sense cost-free to call an editor with any queries or fears. For extra assessment of STR details, check out the data insights site on STR.com.

About STR

STR provides premium facts benchmarking, analytics and market insights for global hospitality sectors. Launched in 1985, STR maintains a presence in 15 nations with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the major provider of industrial authentic estate facts, analytics and on the net marketplaces. For much more information, make sure you go to str.com and costargroup.com.