The U.S. hotel field took in extra than $100 in profits for each individual readily available home for the to start with time considering that Oct 2019 in spite of slowing hotel demand as the summer leisure period wanes.

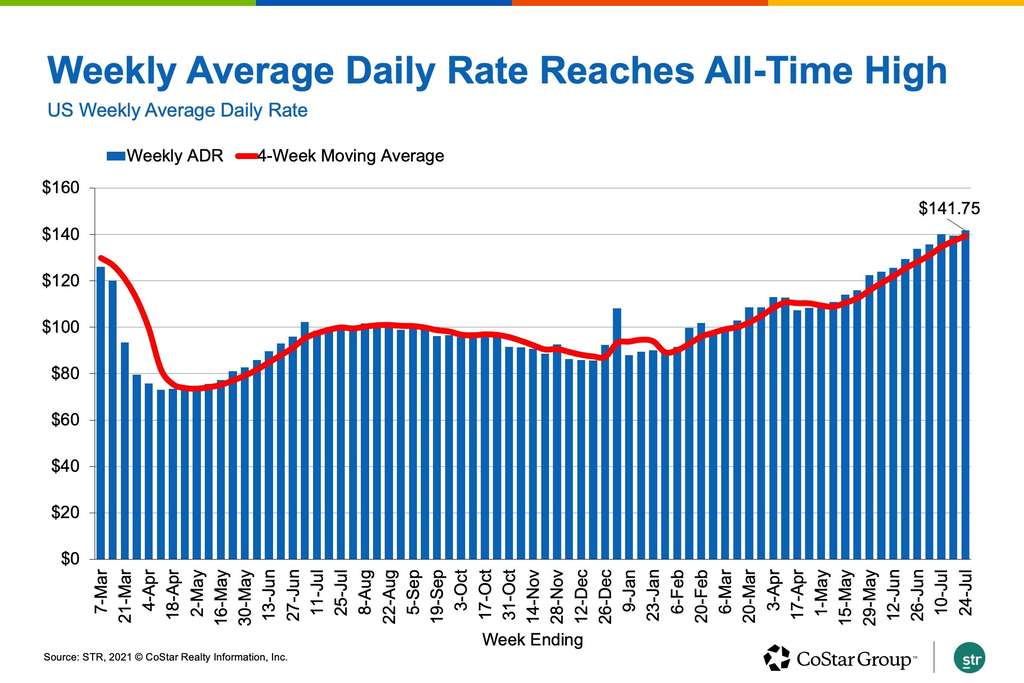

U.S. motels, on regular, also ongoing to accomplish report-higher premiums. Normal day by day level for the 7 days was $142, the best at any time on a nominal basis. When adjusted for inflation, ADR is marginally below the file set in 2019. Charges in excess of the weekend have been also at historic highs, with ADR of $142, although weekday rates pushed previously mentioned $133 for a 3rd consecutive week.

Picture: STR

However, as predicted, need for resort rooms is slowing as summer vacation dissipates and as new situations of COVID-19 rise in the U.S.

Demand from customers was up only .6% from the prior 7 days, nudging resort occupancy to 71.4% — the country’s highest amount considering that October 2019. Retain in head, even so, that the center weeks of July are traditionally the optimum occupancy months of the 12 months. Overall, the U.S. hotel business offered extra than 27 million rooms for a 2nd consecutive week.

Weekday lodge occupancy was 67.6%, the maximum degree given that the begin of the pandemic, when occupancy on the weekend dropped a bit but nonetheless remained higher than 80% for a 2nd consecutive 7 days.

In the U.S., 1.4% of lodge rooms are nonetheless shut. On a overall-area-inventory foundation, which accounts for all those temporarily closed hotels, weekly occupancy was 68.7% and RevPAR was $98 — both of those the maximum ranges since Oct 2019.

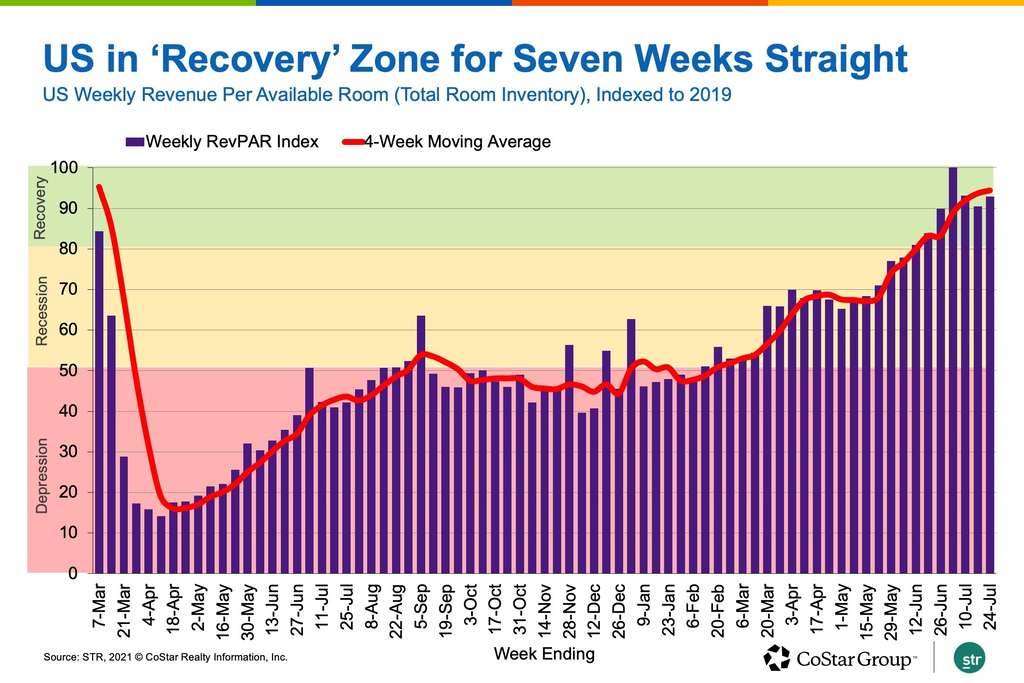

STR’s “Market Recovery Keep track of,” which steps the tempo of the U.S. resort industry restoration by comparing the most up-to-date weekly general performance facts to that of the equivalent 7 days in 2019, shows that the business as a complete is in the “recovery” stage, with RevPAR among 80% and 100% of 2019 stages. It has been at that stage for the earlier 7 weeks.

Image: STR

All round, 90% of all U.S. lodge markets have been either in “recovery” or “peak” for the week, with the latter signifying that RevPAR, on a complete space stock basis, was greater than what it was in the equivalent week of 2019.Marketplace Highlights

Marketplace-stage desire remained solid with 38% of U.S. resort markets marketing more resort rooms in the week ending July 27 than they did in the equivalent week of 2019. That share was nearly unchanged from the earlier week.

Current market occupancy ranged from 94% in Gatlinburg/Pigeon Forge — the chief for the earlier a few months — to 55% in Tucson. Two markets posted weekly occupancy higher than 90%, and 54% of all markets had occupancy of 70% or superior, down only a little from the prior week. Additional than 75% of all motels described 60% occupancy or greater for a next consecutive week, and 21% of all U.S. motels reported occupancy of 90% or greater in the 7 days.

Only two markets, San Francisco and San Jose, claimed RevPAR that was significantly less than 50% of what it was all through the similar 7 days in 2019. Nonetheless, the San Francisco current market is strengthening as weekly occupancy obtained 58% among open up resorts, which was the market’s ideal considering that the get started of the pandemic.

Image: STR

STR’s prime 25 marketplaces created ADR higher than $151, which was the greatest average for the main markets because early 2020. Outdoors the top 25, ADR was once more at a record level, beating the prior high established three months ago.

For the earlier 3 months, far more than 71% of all markets have documented weekly ADR increased than what it was in the equivalent week of 2019. In Maui, ADR topped $573, the best of all markets, as it has been for the earlier 15 months. Other ADR leaders involved the Florida Keys, Hawaii/Kauai, Oahu, and Myrtle Beach front. In all, 17 markets had weekly ADR previously mentioned $200, unchanged from the earlier two weeks.

Isaac Collazo is VP Analytics at STR.

This report represents an interpretation of information gathered by CoStar’s hospitality analytics business, STR. Be sure to feel free to get in touch with an editor with any questions or issues. For a lot more assessment of STR info, check out the data insights web site on STR.com.

About STR

STR provides premium information benchmarking, analytics and market insights for world wide hospitality sectors. Founded in 1985, STR maintains a presence in 15 international locations with a company North American headquarters in Hendersonville, Tennessee, an worldwide headquarters in London, and an Asia Pacific headquarters in Singapore. STR was obtained in October 2019 by CoStar Team, Inc. (NASDAQ: CSGP), the foremost supplier of business real estate information, analytics and on the internet marketplaces. For extra information, be sure to go to str.com and costargroup.com.