In what could be an early indication of the summertime surge, demand from customers for U.S. hotel rooms was at its maximum amount in additional than a calendar year through the week ending May 15.

Resorts sold far more than 22.4 million rooms — just about 1 million much more than the former 7 days, according to the most current Market place Recovery Observe report by STR, CoStar Group’s hospitality analytics agency.

The largest weekly demand gains arrived in markets that are likely to count extra heavily on business enterprise travel, together with Houston, Chicago, Los Angeles, New York and Dallas. Regardless of this improvement, the New York and Chicago hotel marketplaces sold considerably less than fifty percent of the rooms they did all through the same 7 days in 2019. Dallas, Houston and Los Angeles are in a far better placement, selling 80% or extra of the rooms sold during the exact same week in 2019.

Resort demand in thirteen states was 95% or better than the 2019 stage, and 80% of all U.S. marketplaces posted weekly desire gains.

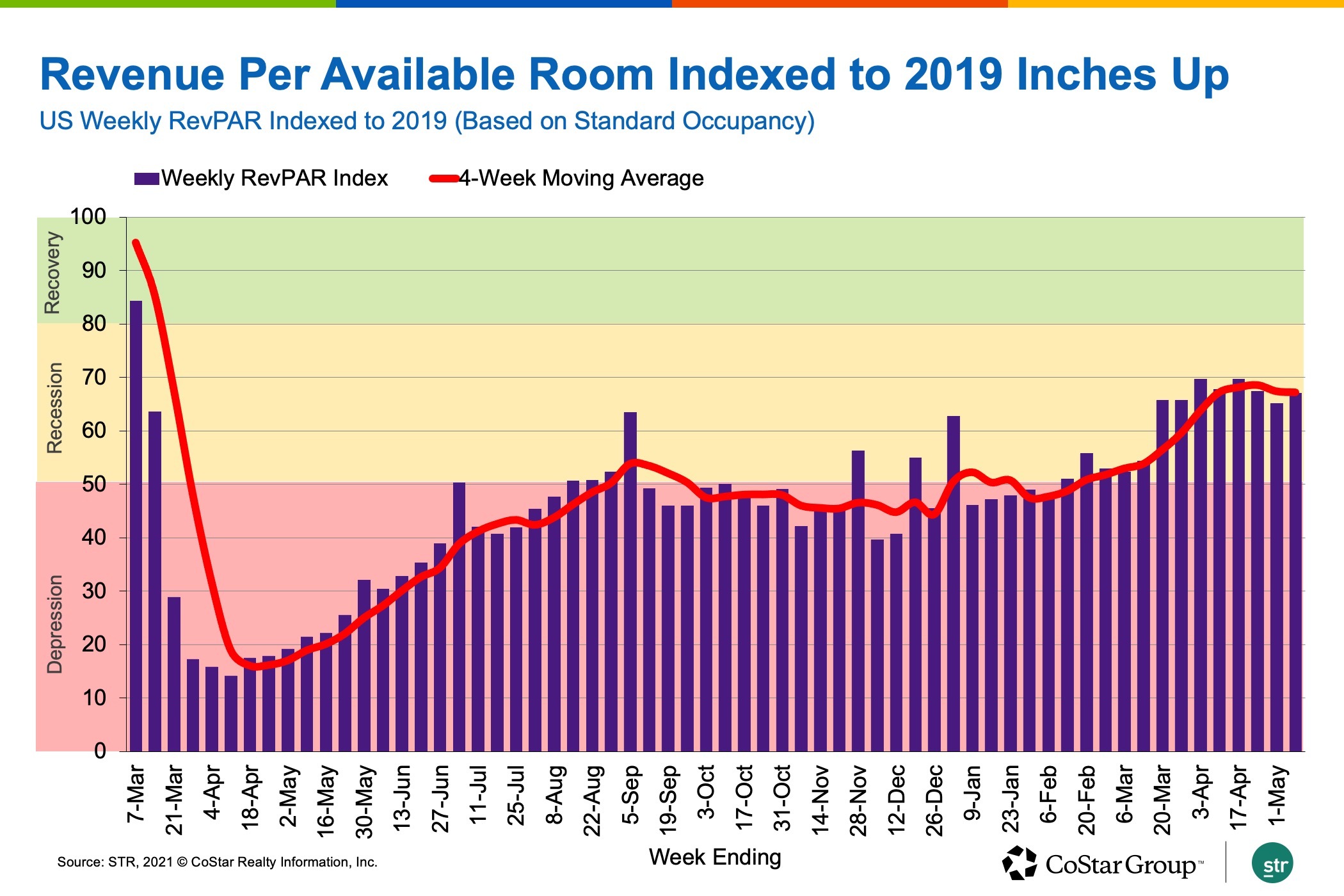

STR’s Industry Recovery Observe compares the most up-to-date weekly general performance data against pre-pandemic 2019 degrees to measure the hotel industry’s restoration, placing U.S. markets in just one of 4 groups — peak, restoration, economic downturn or depression.

For the 7 days ending May perhaps 15, the range of markets in the restoration or peak group — with revenue for every obtainable place at 80% of 2019 concentrations or improved — fell a little bit from 91 to 89. However, only 16 marketplaces have been in the melancholy classification with RevPAR at 50% or much less of 2019 stages — the most affordable quantity recorded by STR’s Market place Restoration Monitor.

San Francisco’s hotel market continues to have the most affordable RevPAR indexed to 2019, adopted by New York, Boston and Washington, D.C. RevPAR in these 4 marketplaces remained less than 30% of what it was in 2019. General, U.S. RevPAR — on a complete home inventory basis, which accounts for briefly closed accommodations — was at 68% of 2019’s amount and its optimum index of the past four weeks.

Gas shortages owing to the hacking of the Colonial Pipeline did not have a destructive impact on resort performance, as demand from customers, occupancy, ordinary each day fee and income per offered room — all critical overall performance metrics — were at or near pandemic-period highs for the 7 days.

General performance was strongest over the weekend, when 73.6% of U.S. resort rooms were occupied — the optimum occupancy amount given that Valentine’s Day weekend in 2020. In general, whole occupancy for the 7 days was 59.1% — the next-maximum level of the previous 62 months.

Throughout the U.S., 56% of motels described occupancy over 60% for the week, which is a new pandemic-period higher. Having said that, for urban inns with 300 or much more rooms, weekday occupancy remained low at around 31% for the week. Occupancy was up a little week-about-week for business enterprise resorts in best 25 urban marketplaces, but even now fairly lower at 45%. Seven marketplaces — like San Francisco, New York, Washington, D.C., and Boston — described weekday occupancy underneath 45%, on a full space inventory foundation.

U.S. resort ADR also attained a pandemic-era higher of $114, up 2.8% 7 days over week, which was the greatest raise of the earlier eight months. That held true for the leading 25 marketplaces, exactly where resort ADR for the 7 days achieved the new higher of $123, up 4.4% from the earlier week.

Comparatively, ADR remains down about 15% from 2019 stages.

U.S. lodge RevPAR elevated 7% 7 days over week and achieved a 62-7 days large of $64, on a total room stock foundation. Accommodations in the prime 25 markets grew RevPAR by 8% for the 7 days — and by 14% around the weekend, when RevPAR topped $100 for the 1st time since the start of the pandemic.

Isaac Collazo is VP Analytics at STR.

This article signifies an interpretation of data collected by CoStar’s hospitality analytics company, STR. Please come to feel free of charge to speak to an editor with any issues or worries. For a lot more analysis of STR info, go to the facts insights blog site on STR.com.