In what could be an early indicator of the summer time surge, demand from customers for U.S. hotel rooms was at its highest level in a lot more than a 12 months for the duration of the 7 days ending May perhaps 15.

The biggest weekly demand from customers gains arrived in markets that are likely to depend additional greatly on enterprise travel, like Houston, Chicago, Los Angeles, New York and Dallas. Regardless of this enhancement, the New York and Chicago resort marketplaces marketed significantly less than 50 percent of the rooms they did through the same 7 days in 2019. Dallas, Houston and Los Angeles are in a improved posture, offering 80% or extra of the rooms marketed throughout the identical 7 days in 2019.

Hotel need in 13 states was 95% or greater than the 2019 amount, and 80% of all U.S. marketplaces posted weekly desire gains.

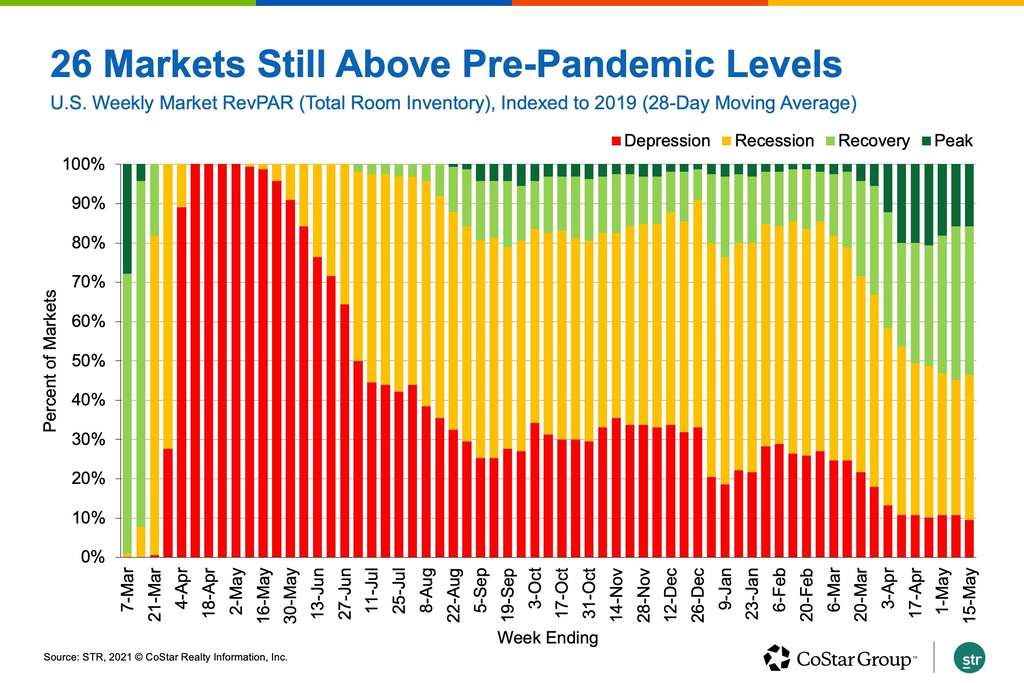

STR’s Market place Recovery Watch compares the most up-to-date weekly effectiveness data from pre-pandemic 2019 stages to measure the resort industry’s restoration, inserting U.S. markets in one of four classes — peak, restoration, recession or depression.

For the 7 days ending May 15, the quantity of marketplaces in the recovery or peak classification — with income per readily available place at 80% of 2019 amounts or improved — fell a bit from 91 to 89. On the other hand, only 16 marketplaces were in the despair group with RevPAR at 50% or a lot less of 2019 degrees — the lowest variety recorded by STR’s Current market Restoration Keep an eye on.

Photograph: STR

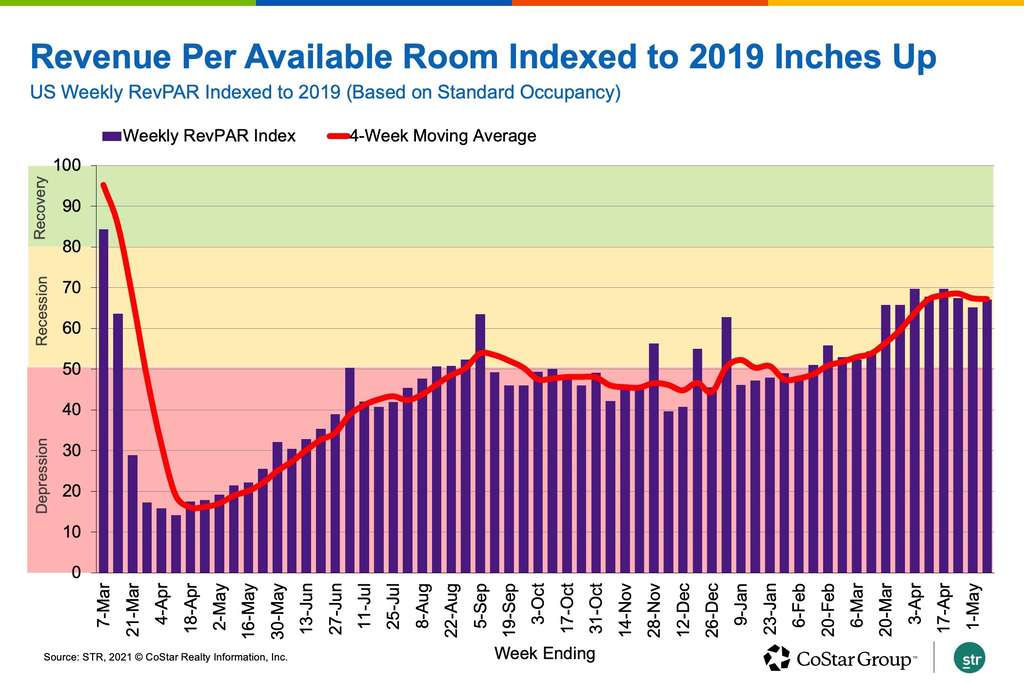

San Francisco’s lodge market place continues to have the cheapest RevPAR indexed to 2019, followed by New York, Boston and Washington, D.C. RevPAR in these 4 marketplaces remained under 30% of what it was in 2019. All round, U.S. RevPAR — on a full area inventory foundation, which accounts for temporarily shut inns — was at 68% of 2019’s degree and its maximum index of the past four weeks.

Photo: STR

Weekly Overall performance Highlights

Gasoline shortages due to the hacking of the Colonial Pipeline did not have a unfavorable affect on hotel efficiency, as demand from customers, occupancy, regular daily charge and revenue for every available area — all vital functionality metrics — were at or close to pandemic-era highs for the 7 days.

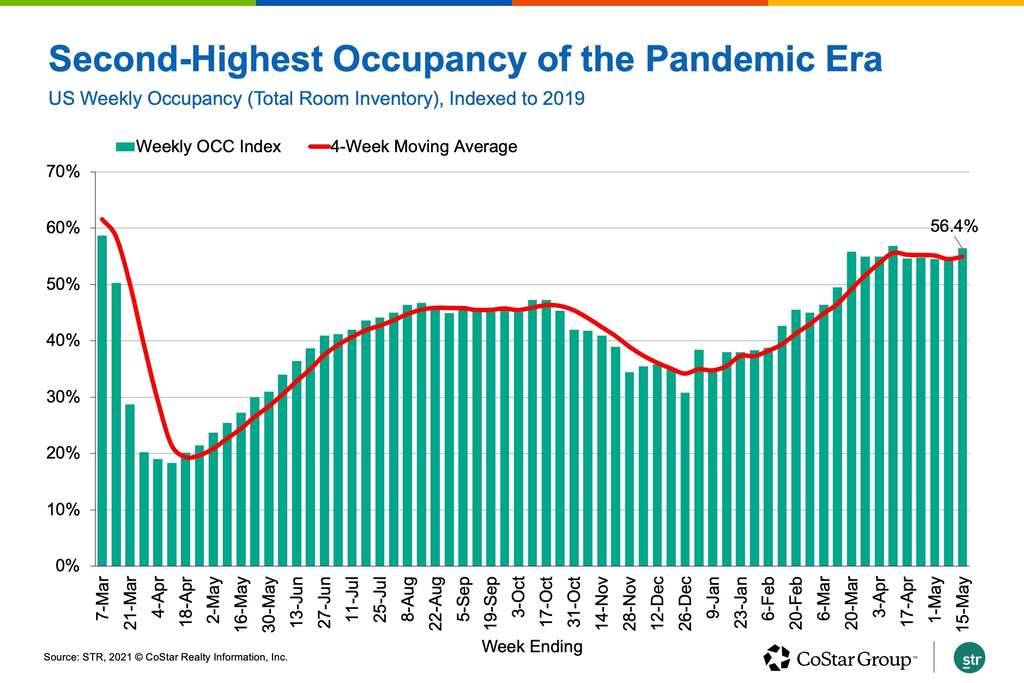

General performance was strongest above the weekend, when 73.6% of U.S. hotel rooms were occupied — the greatest occupancy degree because Valentine’s Working day weekend in 2020. In general, complete occupancy for the week was 59.1% — the next-highest degree of the earlier 62 months.

Image: STR

Across the U.S., 56% of accommodations described occupancy over 60% for the 7 days, which is a new pandemic-era substantial. Nonetheless, for urban accommodations with 300 or extra rooms, weekday occupancy remained reduced at close to 31% for the 7 days. Occupancy was up a bit week-above-7 days for business enterprise accommodations in prime 25 urban markets, but nonetheless rather low at 45%. 7 marketplaces — such as San Francisco, New York, Washington, D.C., and Boston — documented weekday occupancy underneath 45%, on a whole area stock foundation.

Photo: STR

U.S. lodge ADR also attained a pandemic-era superior of $114, up 2.8% 7 days over week, which was the greatest improve of the previous 8 weeks. That held real for the top rated 25 marketplaces, in which hotel ADR for the week attained the new substantial of $123, up 4.4% from the past 7 days.

Comparatively, ADR stays down about 15% from 2019 levels.

U.S. resort RevPAR amplified 7% week above week and attained a 62-week superior of $64, on a total room stock basis. Motels in the major 25 markets grew RevPAR by 8% for the 7 days — and by 14% in excess of the weekend, when RevPAR topped $100 for the very first time due to the fact the start off of the pandemic.

Isaac Collazo is VP Analytics at STR.

This posting signifies an interpretation of info gathered by CoStar’s hospitality analytics company, STR. Be sure to come to feel cost-free to call an editor with any issues or considerations. For additional assessment of STR details, check out the facts insights weblog on STR.com.

About STR

STR provides quality data benchmarking, analytics and marketplace insights for world-wide hospitality sectors. Launched in 1985, STR maintains a existence in 15 countries with a company North American headquarters in Hendersonville, Tennessee, an global headquarters in London, and an Asia Pacific headquarters in Singapore. STR was obtained in October 2019 by CoStar Team, Inc. (NASDAQ: CSGP), the top provider of industrial true estate info, analytics and on-line marketplaces. For far more data, you should check out str.com and costargroup.com.