Royal Caribbean Cruise line’s “Ovation of the Seas” on Dec 29, 2017 in Sydney, Australia. The cruise … [+]

With the acceptance of Pfizer

Royal Caribbean has greater fundamentals than Hyatt

Right before the pandemic, Royal Caribbean’s profits development was much more robust than Hyatt, propelled by soaring potential and a steady occupancy rate. Royal Caribbean’s revenues greater by 24% from $8.7 billion in 2017 to $10.9 billion in 2019, vs . a 12% growth in Hyatt’s revenues above the similar interval. As Hyatt has been marketing its owned hotels to develop its franchise enterprise, the web margins are afflicted by gains or losses. For that reason, we review the running hard cash circulation margin to discover far better cash era abilities.

In 2019, Hyatt and Royal Caribbean reported an working income move margin of 8% and 34%, respectively. Hyatt incurred $611 million of operating funds outflow in 2020 when compared to $396 million of running funds technology in 2019. Even so, Royal Caribbean incurred $3.7 billion of running income outflow in contrast to $3.7 billion technology in 2019. So, Royal Caribbean can recoup its pandemic losses within a year as compared to a increased period required by Hyatt.

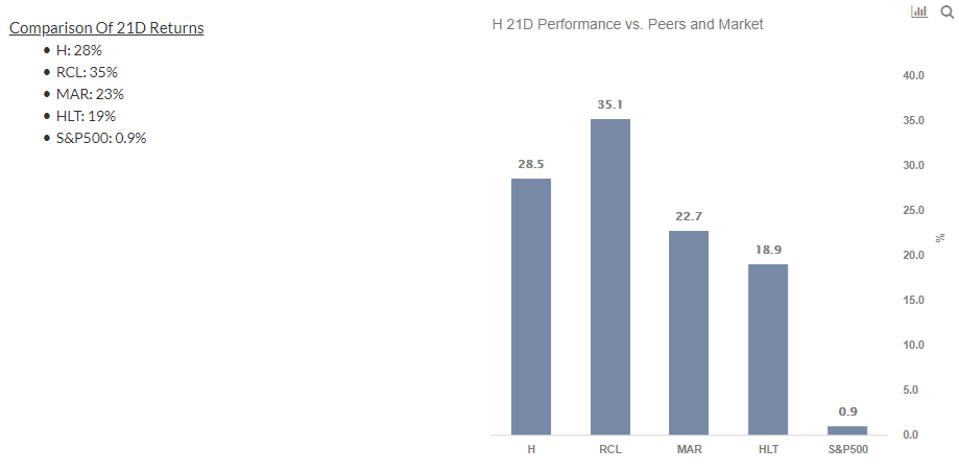

Hyatt 21 Working day General performance

Resort and cruise line stocks have outperformed broader markets this calendar year

In the earlier twenty-a single days, Royal Caribbean, Hyatt, Marriott, and Hilton stocks have received 35%, 28%, 22%, and 19%, respectively. On the lookout at the past 5-day and ten-working day general performance, the rally seems to be growing much better in spite of a stagnation observed in broader marketplaces. Also, cruise corporations have been observing pent-up desire for the second 50 percent of 2021. Offered the ongoing momentum in the vacation sector, we think that Royal Caribbean stock has significant room for progress.

As the slump in vacation need carries on to weigh on the hospitality sector, 2020 has created numerous pricing discontinuities which can present appealing buying and selling opportunities. For illustration, you are going to be stunned how the inventory valuation for Expeditors International vs. LGI Properties

See all Trefis Cost Estimates and Download Trefis Facts here

What is at the rear of Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Groups | Solution, R&D, and Marketing and advertising Groups