Problems have worsened for a part of M&T Bank’s business true estate portfolio.

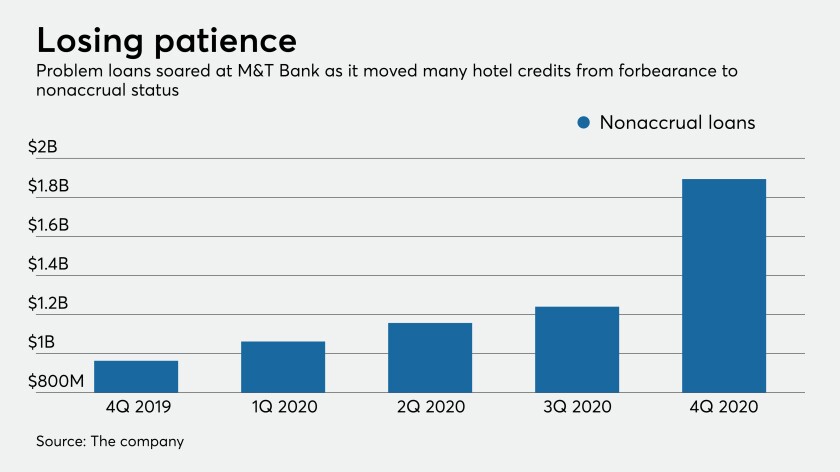

Nonaccrual financial loans at the $143 billion-asset financial institution jumped by 42% in the fourth quarter from a few months before, to nearly $1.9 billion, symbolizing about 2% of full financial loans. About 80% of the boost, or $530 million, was tied to hotel loans.

A “handful” of tough-hit lodge financial loans were moved to nonaccrual status in the fourth quarter as house owners, specially all those in major metropolitan areas, go on to battle with lower occupancy fees and lessened money, Main Economical Officer Darren King explained all through a Thursday earnings contact.

Regardless of the surge, M&T has “good visibility” into problems spots and plenty of reserves to take in probable losses, King explained.

“I don’t want to consider off my shoes and socks to count the quantity of [loans], which is a superior issue,” King explained. “We know specifically how many there are. We know just the place they are. And we have experienced a very long-standing romance with all of these clientele. … The place we sit ideal now, we sense relaxed that we have our arms around these.”

Industry specialists have been waiting for months to see how M&T and other banking companies would handle resort interactions as deferral periods finish. Though other commercial clients started off to get well final summer season, the Buffalo, N.Y., financial institution warned in October that commercial true estate could confront difficulties.

M&T recorded a $75 million bank loan-loss provision in the fourth quarter, boosting the complete quantity of resources set aside very last yr to $800 million. The go reflected ongoing financial uncertainty and a lack of clarity when it will come to a lot more federal stimulus and “the ultimate collectability” of CRE loans, King explained.

Web cost-offs far more than tripled those people from a quarter previously, totaling $97 million, even though none of the create-downs involved financial loans in the hotel portfolio. Fairly, they were being tied to two regional malls and a travel-similar supply service.

M&T in the fourth quarter “restructured considerably all of [its] restricted exposure” to regional mall operators, which have been below pressure pre-pandemic and slid into default in the course of the crisis, King reported. The determination to cost the financial loans off “pretty considerably gets rid of our exceptional publicity to any closed malls,” he claimed.

M&T’s income rose by 27% from the third quarter but fell 4% from a yr previously, to $471 million.

A shiny location for M&T was its automobile dealership ebook, which amplified by $231 million throughout the fourth quarter as sellers bulked up their inventories. Though $4.2 billion of that portfolio experienced been in a forbearance program very last calendar year, all debtors are now present-day, King said.

Sellers “have just had a superb yr and, in some cases, had document profits,” King claimed. “So which is actually the sector that we’re observing.”

As for the hotel loans in nonaccrual standing, M&T carries on to get the job done with borrowers, featuring selections these types of as deferrals or modifying loans to keep away from foreclosures.

“We’re bankers, not lodge operators, and so we’d instead enable the experts do that,” King reported.

“There’s a bunch of unique alternatives and ways that we can do the job with purchasers to try out and continue to keep them in enterprise and keep them working as prolonged as achievable,” he added. “Obviously, us becoming in that company is completely the very last resort.”