KIEV, UKRAINE – 2019/06/08: In this picture illustration the JetBlue Airways logo is witnessed exhibited on … [+]

The shares of JetBlue Airways (NASDAQ: JBLU) have rallied 30% in the previous twenty-a person days virtually reaching pre-Covid amounts, driven by the 2nd round of payroll help by the U.S. authorities and the recent surge in passenger figures at TSA checkpoints. Will JBLU inventory maintain its worth or observe a downside? Taking into consideration Reserving Holdings inventory (NASDAQ: BKNG) as a proxy for journey desire, the latest surge implies that ongoing vaccination is alleviating travel fears with the probability of a rebound in travel desire afterwards this year. Trefis compares historical inventory price tag traits of JetBlue and Reserving Holdings in an interactive dashboard assessment, JBLU Stock Has 51% Probability Of A Drop Above The Upcoming Month Following Mounting 1.8% In The Final 5 Days.

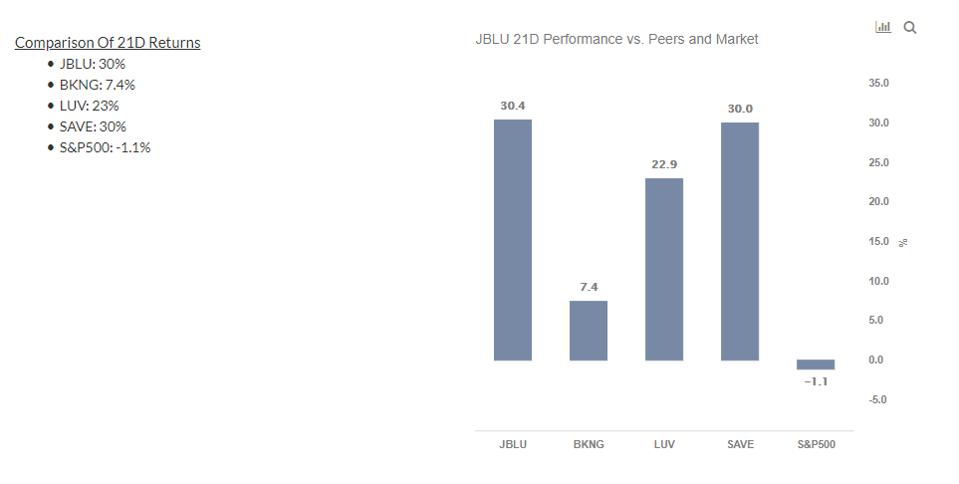

Airline and OTA shares have outperformed broader markets this calendar year

In the past 20-one particular times, JetBlue, Southwest, and Spirit Airlines stocks have rallied 30%, 23%, and 30%, respectively – better than 7.4% gain noticed in BKNG inventory. Seeking at the earlier ten-day efficiency, the travel market is touching new heights even though broader markets are observing a correction. Essentially, JetBlue Airways and Booking Holdings observed a similar 60% (y-o-y) top-line contraction in 2020 as travel desire fell to multi-yr lows due to the pandemic.

Is JBLU inventory trading at a dangerous degree?

With companies applying price tag manage and dollars preservation actions, a comparison of income burn level can be thought of as a measure of operational performance. In 2020, JetBlue Airways burned $234 million (functioning money outflow like the impression of payroll guidance method) whilst Reserving Holdings generated $85 million. Thinking about JetBlue and Reserving Holding’s historical money technology abilities, both of those corporations can recoup pandemic-connected losses within just 1 12 months as demand traits again to normal.

As Scheduling Holding’s stability sheet noticed a reduced pandemic effects than JetBlue, BKNG stock has surpassed pre-Covid ranges when JetBlue inventory stays a little under. Curiously, airline tickets reserved via Booking Holdings amplified by 4% (y-o-y) in Q4’20. For that reason, we feel that JBLU stock has low draw back possibility supported by vacation demand from customers, stringent value control actions, and a second spherical of governing administration support.

Although the hospitality sector observes a restoration, the coronavirus pandemic has developed quite a few pricing discontinuities which can provide interesting investing alternatives. For instance, you will be astonished how the stock valuation for Expeditors Worldwide vs. LGI Homes exhibits a disconnect with their relative operational expansion. You can find quite a few this sort of discontinuous pairs here.

See all Trefis Price Estimates and Download Trefis Information here

What is driving Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Groups | Solution, R&D, and Advertising Teams