Hyatt has just announced a important acquisition, nevertheless I have a challenging time finding far too energized in this article, particularly given the quantity of dollars becoming invested below.

Hyatt acquiring Apple Leisure Group for $2.7 billion

Hyatt has entered into a definitive agreement to purchase Apple Leisure Group (ALG), which is a resort-administration solutions, travel, and hospitality group. ALG is getting obtained for $2.7 billion in hard cash from KKR and KSL Money Associates, and the transaction is predicted to near in the fourth quarter of 2021.

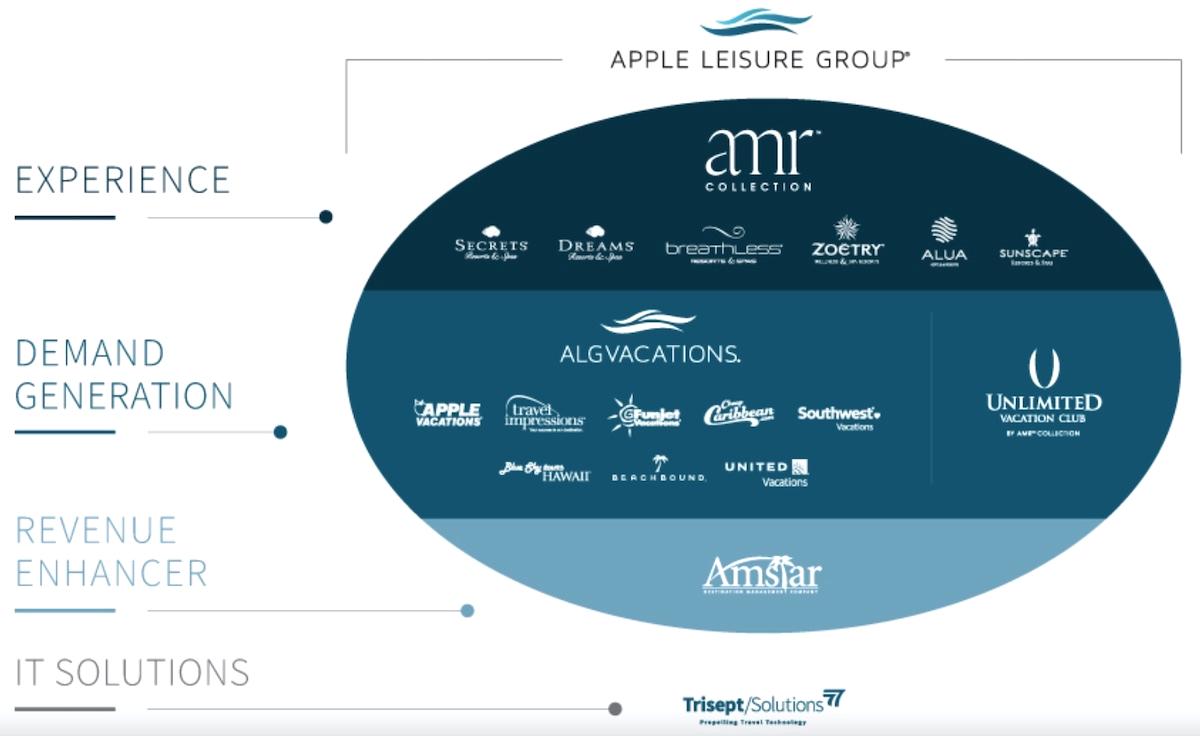

For those people not familiar with ALG, it is a organization largely focused on providing deal holidays, along with handling resorts in the Caribbean, Mexico, Europe, and outside of. ALG manages AMResorts, which includes Alua, Breathless, Dreams, Tricks, Sunscape, and a lot more. ALG also has above a dozen subsidiaries, including Apple Holidays, CheapCaribbean.com, Southwest Vacations, United Vacations, Endless Holiday Club, and far more.

ALG’s portfolio incorporates in excess of 33,000 rooms operating in 10 international locations. The portfolio has grown at a quick rate, from 9 resorts in 2007 to roughly 100 resorts by the end of 2021, with 24 more executed bargains in the pipeline.

How Hyatt explains Apple Leisure Team acquisition

Hyatt is paying out a large sum of income on this acquisition. As a point of comparison, in 2018 Hyatt obtained Two Roads Hospitality (which introduced us brand names like Alila and Thompson) for $480 million. Now the firm is paying a lot more than 5 instances as significantly on Apple Leisure Team.

So, what is the rationale? As it’s explained, here’s what Hyatt is hoping to achieve by obtaining ALG:

- An expanded footprint in luxurious and resort journey — this acquisition is expanding Hyatt’s existence in luxury leisure vacation, as it will double the amount of resorts Hyatt manages, and will allow Hyatt to offer the major portfolio of luxury all-inclusive resorts in the environment

- Major enlargement in Europe — this will expand Hyatt’s European footprint by 60%, and will enable the Hyatt brand to enter 11 new European marketplaces

- An expanded platform for progress — ALG’s developer and owner base will grow Hyatt’s interactions with committed companions in essential complementary geographies

- Lodge entrepreneurs will gain — proprietors of Apple Leisure Team resorts will have access to a much broader assortment of brands (in other text, we could see some of these accommodations rebranded below a person of Hyatt’s present brands), alongside with the backing of Hyatt’s international distribution, sales, and marketing and advertising

- Far more solutions for Planet of Hyatt customers — as you’d hope, customers will have entry to extra motels, irrespective of whether they’re on the lookout to gain or redeem details

- This will increase Hyatt’s end-to-conclusion leisure travel choices — ALG Vacations is a single of the premier packaged tour providers and leisure journey distribution platforms in North America, so I suppose Hyatt could get a lot more into the deal getaway business enterprise

- This will allow Hyatt to increase its asset-mild system — ALG is asset-light, and with Hyatt continuing to offer authentic estate belongings, the corporation hopes to increase the percent of earnings produced from fees

Here’s how Hyatt CEO Mark Hoplamazian describes the acquisition:

“With the asset-mild acquisition of Apple Leisure Group, we are thrilled to provide a hugely attractive impartial resort management system into the Hyatt family. The addition of ALG’s qualities will quickly double Hyatt’s worldwide resorts footprint. ALG’s portfolio of luxurious brands, leadership in the all-inclusive phase and large pipeline of new resorts will increase our access in current and new marketplaces, which includes in Europe, and additional speed up our industry-major web rooms progress. Importantly, the mix of this worth-producing acquisition and the $2 billion enhance in our asset sale motivation will rework our earnings profile, and we expect Hyatt to achieve 80% cost-based mostly earnings by the close of 2024.”

My choose on Hyatt’s acquisition

When we discovered that Hyatt was on the lookout to acquire a lodge manufacturer in buy to expand in Europe, I was psyched. It seems that this was Hyatt’s solution to that intention, and now my exhilaration is out of the blue long gone. A few views:

- This reflects that Hyatt is looking to grow in the leisure marketplace, which is most likely rational at this stage, specified that it’s anyone’s guess when business enterprise travel will get again to 2019 degrees

- This is a enormous order — Hyatt’s current market cap is $7.3 billion, and this is a $2.7 billion acquisition, so proportionally this is just about like when Marriott bought Starwood

- I see consistent mention of this getting a “luxury resort” acquisition, still this is the exact enterprise that owns CheapCaribbean.com?

- Hyatt is receiving even worse than Marriott in this article in phrases of the range of resort manufacturers it will have

- Browsing Apple Leisure Group’s portfolio, there is not a solitary lodge that jumps out and me and helps make me say “I simply cannot wait around to stay/redeem points right here!”

- I seriously want Hyatt’s acquisitions had been a bit extra strategically centered for buyers even though I’m not a large IHG admirer, I like how IHG acquired Kimpton, Regent, and Six Senses, all of which are excellent manufacturers, and let qualified growth, alternatively than by some means incorporating all the things (and combined, people acquisitions value a portion of what Hyatt is spending listed here)

- One particular cannot assist but marvel the prolonged-term influence on Entire world of Hyatt for acquisitions like these, in particular because they are going immediately after a price tag-delicate leisure holiday getaway offer team here presumably these accommodations have a reduced payment structure and really feel that they really don’t need to have to give as quite a few rewards, due to the fact that may well not be what motivates people to e book a single of these properties

Base line

Hyatt is acquiring Apple Leisure Group in its greatest acquisition however. This will greatly broaden Hyatt’s footprint in the all-inclusive resort industry, especially in the Caribbean, Mexico, and Europe. Individually I’m not terribly enthusiastic about this, but presumably some others truly feel in another way. I’d adore to know if there’s an angle below that I’m missing.

What do you make of Hyatt’s acquisition of Apple Leisure Team?