The Manner Gallery is a person of Lagardère Journey Retail’s effective airport concepts.

In the room of a calendar year, Mainland China has turn into crucial for a single of the environment best obligation-absolutely free and journey retailers—and 2021 could see the country acquire even further ground.

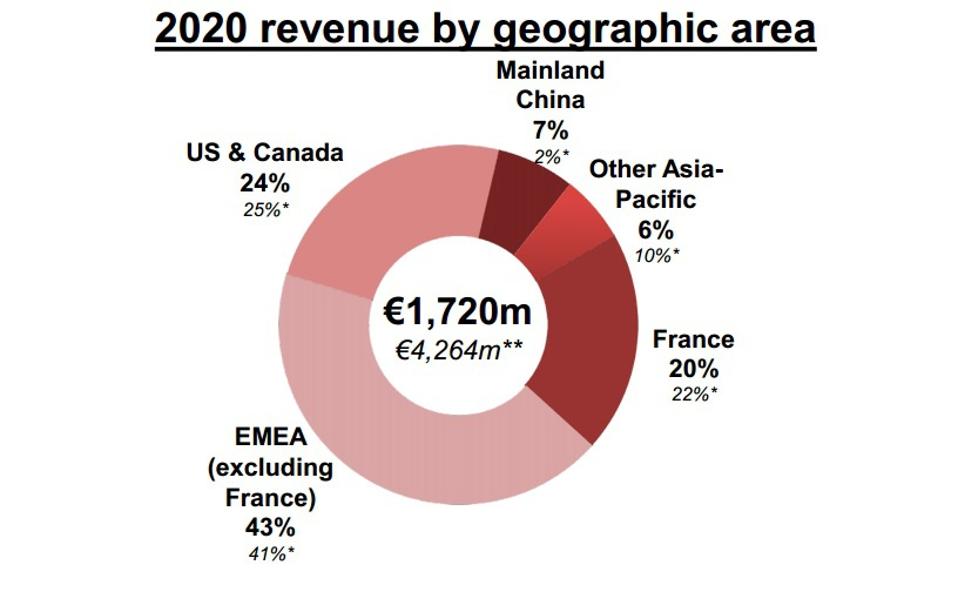

The Covid-19 pandemic and accompanying air journey constraints and lockdowns led to a earnings collapse at Lagardère Travel Retail of 60% to €1.7 billion ($2.1 billion), much more or much less in line with the drop in world wide air passenger and traffic developments. But by location, China—where Lagardère has a quantity of responsibility-compensated airport locations and a solid luxury vogue footprint—increased its income share from 2% in 2019 to 7% final year.

The French travel retailer mentioned that all world regions ended up affected by the coronavirus disaster with the exception of Mainland China which grew 22% on the back of strong domestic website traffic. The mainland market is now larger than the relaxation of Asia Pacific whose share contracted sharply from 10% to 6%.

Very last year, at the time of a slew of new boutique openings for the corporation, Eudes Fabre, CEO for North Asia described the return of domestic vacation in China as “breathtaking to observe”. He additional: “The advancement of China’s center class and its appetite for luxurious makes has supported a sharp rebound in our company right here.”

This year, China’s star need to shine even much more brightly as Lagardère Journey Retail has extra its initially location in Hainan exactly where its competitors Dufry and DFS have also opened retail doorways.

China is creating its mark by raising its share of the pie.

Financial investment focus has also altered. When the enterprise greatly lower money expenditure very last calendar year, investing on IT tasks and Mainland China was enhanced. It meant that these two precedence locations manufactured up 40% of funds shelling out very last 12 months, almost double the 22% share from the 12 months just before. The enterprise could plough but additional into the Chinese current market this year in the hope of a swift payback—while continuing to trim charges in other places.

Three pillars re-well balanced

All the positives from Mainland China simply cannot, however, cover the world-wide revenue strike to Lagardère Travel Retail. It was felt most strongly in the obligation-free and style segment whose share of gross sales shrank from 40% in 2019 to 35% in 2020. This has experienced the result of re-balancing the company’s a few pillar design in favour of travel essentials which now has the lion’s share of 44% (from 38% in 2019) though foodservice retained 21%. This will in all probability be a temporary impact until finally world wide vacation returns.

Commenting on the over-all outcome on social media, Dag Inge Rasmussen, chairman and CEO at Lagardère Vacation Retail reported: “Nothing could have geared up us for the upheaval of the world pandemic, and its extraordinary outcomes on our company.” Nonetheless he also mentioned that the crisis has led to nearer interactions with company partners declaring: “There have been complicated discussions but I sense we have collectively built better resilience and cast further ties.”

For guardian group, Lagardère, whose other core small business is publishing, the journey retail arm was mainly dependable for pushing profits down by 38% to €4.4 billion. Losses strike €660 million versus €15 million in 2019. The organization experienced a liquidity cushion of €1.6 billion at the stop of 2020, break up in between €687m in money and a €950 million undrawn revolving credit history facility.