U.S. accommodations are a hot trader commodity despite the industry’s surging dilemma of not sufficient personnel heading into the summertime vacation season.

While daily charges, earnings, and assets values are all very likely to return to pre-pandemic ranges — and even eclipse them — the lodge industry’s labor marketplace faces long lasting improvements. Other industries like retail supply more aggressive wages to resort employees with effortlessly transferrable abilities.

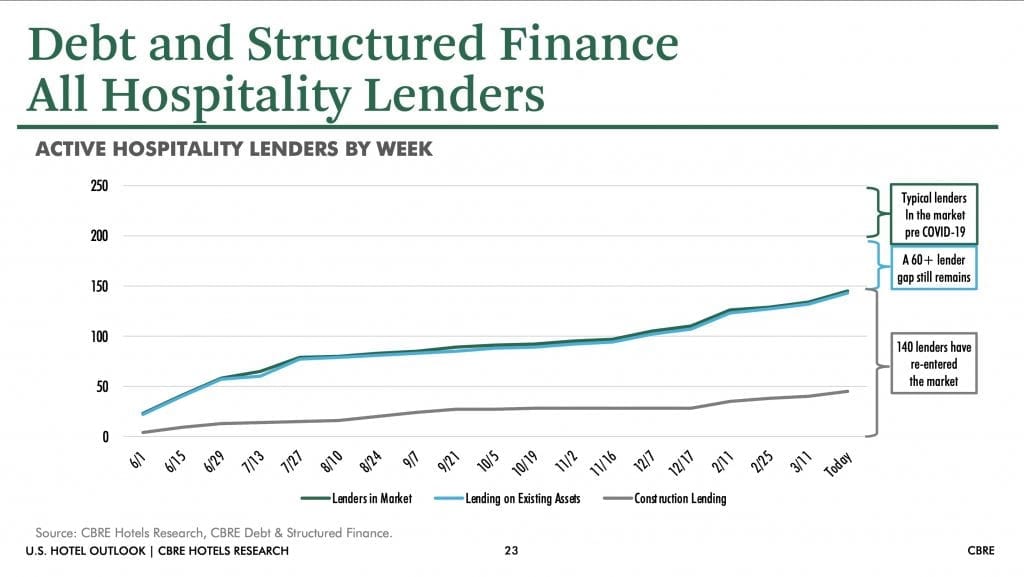

But traders do not appear to be to head that inflammation operational difficulty. There’s only about a 60-lender gap between today’s current market and the pre-pandemic just one in the U.S., according to CBRE’s “U.S. Hotels Condition of the Union” report.

“The expedited return of funds to the sector is faster than what we’ve seen traditionally,” reported Mark Owens, head of hospitality capital markets at CBRE Lodges. “This is a considerably far better return of liquidity to the industry than we’ve seen historically for lodges, so that bodes truly well for all of us.”

There was a lot more of a lag subsequent the Sept. 11 terrorist assaults and the Fantastic Fiscal Crisis, irrespective of individuals gatherings acquiring much less of an impact on profitability and occupancy.

Loan companies immediately returned to the hotel market place subsequent a sharp fall early in the pandemic (Credit: CBRE)

Given their willingness to get on more threat than a conventional financial institution, personal debt fund traders have been the quickest to return to the sector following pandemic pullbacks. A bank, which normally has greater financing terms, will ordinarily lend as considerably as 60 p.c of the benefit of a serious estate asset whilst credit card debt resources will from time to time go as superior as 75 percent.

Corporations like Bainbridge DXS and Torrey Pines Hotel Team as very well as CGI Merchant Group are among the the numerous to start hotel investment money through the pandemic.

But lifetime insurance coverage businesses remaining in the resort lending house is one more economic anomaly to this downturn, Owens mentioned. These investors, ordinarily conservative with funds, took as extended as 24 months to return to the resort business in prior cycles. If they went absent at all during the pandemic, it was only for a make a difference of weeks.

The only form of investor that carries on to lag are commercial home finance loan-backed securities, a group of mortgages pooled as a person that lodge builders use to build new jobs. Nearly a quarter of lodge CMBS financial loans were at least 30 times delinquent very last summer time, but that figure steadily declined to 16 percent, as of late March.

“All of the distinctive lender kinds, with the exception of CMBS, seriously came back again fairly rapidly,” Owens mentioned. “And that just aids the engine of transaction activity function.”

The buyers returning to the resort marketplace nonetheless are likely to favor present properties instead than new building, partly because of the soaring expenses of setting up resources.

Steel rates jumped nearly 18 % just last month whilst lumber — made use of on normally far more affordable-to-make midscale and prolonged-stay hotels — was up far more than 6 per cent, according to the U.S. Bureau of Labor Figures.

That puts a key rate swing amongst the setting up levels and development on tasks that can take as substantially as 36 months to make. Developers continue to in the pre-arranging course of action may perhaps decide to keep off on development to see if prices relaxed down in the subsequent two several years.

“Costs are growing substantially,” stated Rachael Rothman, head of lodge analysis and info analytics for CBRE Inns. “You have to surprise whether or not or not promotions that originally penciled out 18 months ago are heading to pencil out today.”

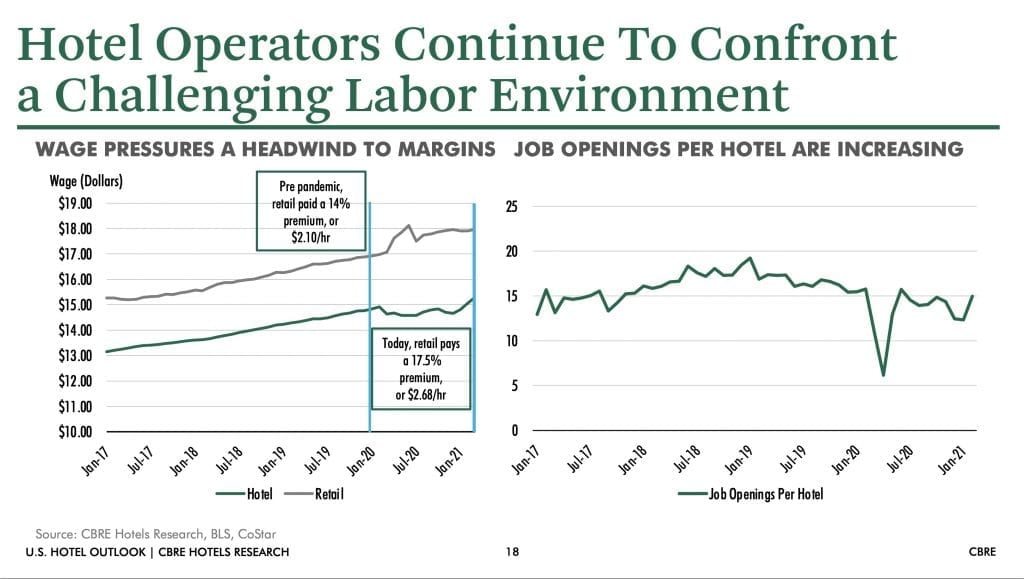

A Labor Crisis That May Under no circumstances Go Absent

Even with the pandemic placing hundreds of hundreds of hotel employees out of work due to minimal occupancies, the sector is experiencing a massive labor scarcity. U.S. inns are about 600,000 workforce off pre-pandemic amounts, according to the U.S. Labor Section. But the business is expected to have one of its busiest — if not the busiest — summers at any time.

Some field analysts rationalize the labor crisis is driven by the extra $300 in federal unemployment rewards place in position from the $1.9 trillion pandemic reduction measure passed previously this yr. The further funding, in put by early Septmeber, offers persons fewer incentive to return to get the job done, the thinking goes. But Rothman sees other variables at engage in.

“Maybe it is some thing to do with unemployment, but I assume it’s the normal sector dynamic as very well,” she added. “You’ve had occupancy come back so substantially faster than folks assumed mainly because of the vaccines.”

Occupancy premiums that jump 30 per cent in a make a difference of months have supervisors scrambling to simply call employees again, but individuals former workers may perhaps not be there to choose up the cellphone. Many retail outlets like grocery stores ongoing to seek the services of for the duration of the pandemic, and they often pay superior than accommodations.

Greater wages in industries like retail could guide some frontline hotel employees to permanently leave the field. (Credit score: CBRE)

The retail field has a 17.5 p.c, or $2.68 for every hour, wage quality for frontline employees to lodges, according to the CBRE report. This was even a challenge ahead of the pandemic, when retail experienced a 14 percent wage high quality over inns.

Retail shifts can also be shorter and much more adaptable than motels, which has a “strict demand from customers pattern” all-around look at-in and check-out. That puts tension on resort homeowners to maximize wages in get to keep on being aggressive among the fellow hoteliers and various industries.

“Owners and models and operators need to be ready for over-inflation boosts in labor [costs], just as they ended up observing prior to the pandemic,” Rothman reported.