Canadian travel startup Hopper has raised a $170 million Series F spherical, led by Money 1. The U.S. financial institutions and credit card business is also coming on board as a strategic husband or wife, to start Capital One Journey, which is the to start with instantiation of Hopper’s new B2B platform, Hopper Cloud.

This is Hopper’s 2nd elevate in a 12 months that has been marked by turmoil for the vacation field, owing to the disruptions induced by the world COVID-19 pandemic. Last March, Hopper elevated $70 million, in a round that saw Inovia Cash essentially make its very first expense in the startup — primarily at the quite instant that points appeared most bleak for the vacation marketplace in general, and in distinct for airfare-concentrated Hopper.

I requested Inovia lover Patrick Pichette about his selection to back Hopper at a moment when a whole lot of buyers the place in essence on pause pending the fallout of the just-declared pandemic, and about their renewed support with a contribution to this most recent round.

“What we experienced viewed in the prior six months, nine months ti a yr at Hopper was a transformation of a business right before COVID,” Pichette said. “And 2nd is our thesis at Inovia — we spend in firms with the frame of mind of, ‘Does this company have a shot at staying a global organization?’ If it is gonna be a Canadian firm, it could be fantastic, but it’s just not for us. Also, does it really leverage tech in a way that is differentiated? And so if it has these attributes, then we’re interested.”

That pre-COVID transformation that Pichette is referring to is Hopper’s change from becoming in essence a equipment finding out-run least expensive fare finder, to what co-founder and CEO Fred Lalonde states is truly substantially more of a fintech corporation. That characterization mainly comes from Hopper’s capability to offer you prospects monetary adaptability all around their journey bookings.

“The true fundamental sea change is that Hopper moved away from getting a predominantly air vacation corporation to a true fintech,” Lalonde spelled out in an job interview. “Price freeze is a great case in point. We let you to occur in and keep the price tag of a booking for between two hrs and 14 days. If the selling price goes up you pay what you froze, and if it goes down and you pay back the lower value. We have adaptable day ideas, cancellation designs, where by you can choose a non-refundable, non-changeable ticket and for a nominal price, make it changeable. And one particular that is working definitely surprisingly effectively is the disruption insurance coverage.”

Hopper’s disruption coverage is mainly a rebooking provider for missed connections. Whatever the reason, if you take place to miss a link on a multiple-leg flight and you have opted for the disruption insurance coverage provider, you are going to be offered with each individual flight leaving that particular airport, irrespective of airline, to your desired destination and you can decide on an offered option at no supplemental charge.

Understandably, Hopper’s overall organization took a strike all through the pandemic, and that experienced a steep price tag: The company laid off close to 45% of its workers previous 12 months as a end result of the dip in demand from customers. But for the bookings that were remaining built, Lalonde states the enterprise was looking at incredibly significant connect rates for its products and solutions that deliver far more peace-of-intellect all over booking balance. Now, with the U.S. journey market in unique getting its initial measures toward restoration, Lalonde states conduct is not altering as a lot as his corporation had predicted.

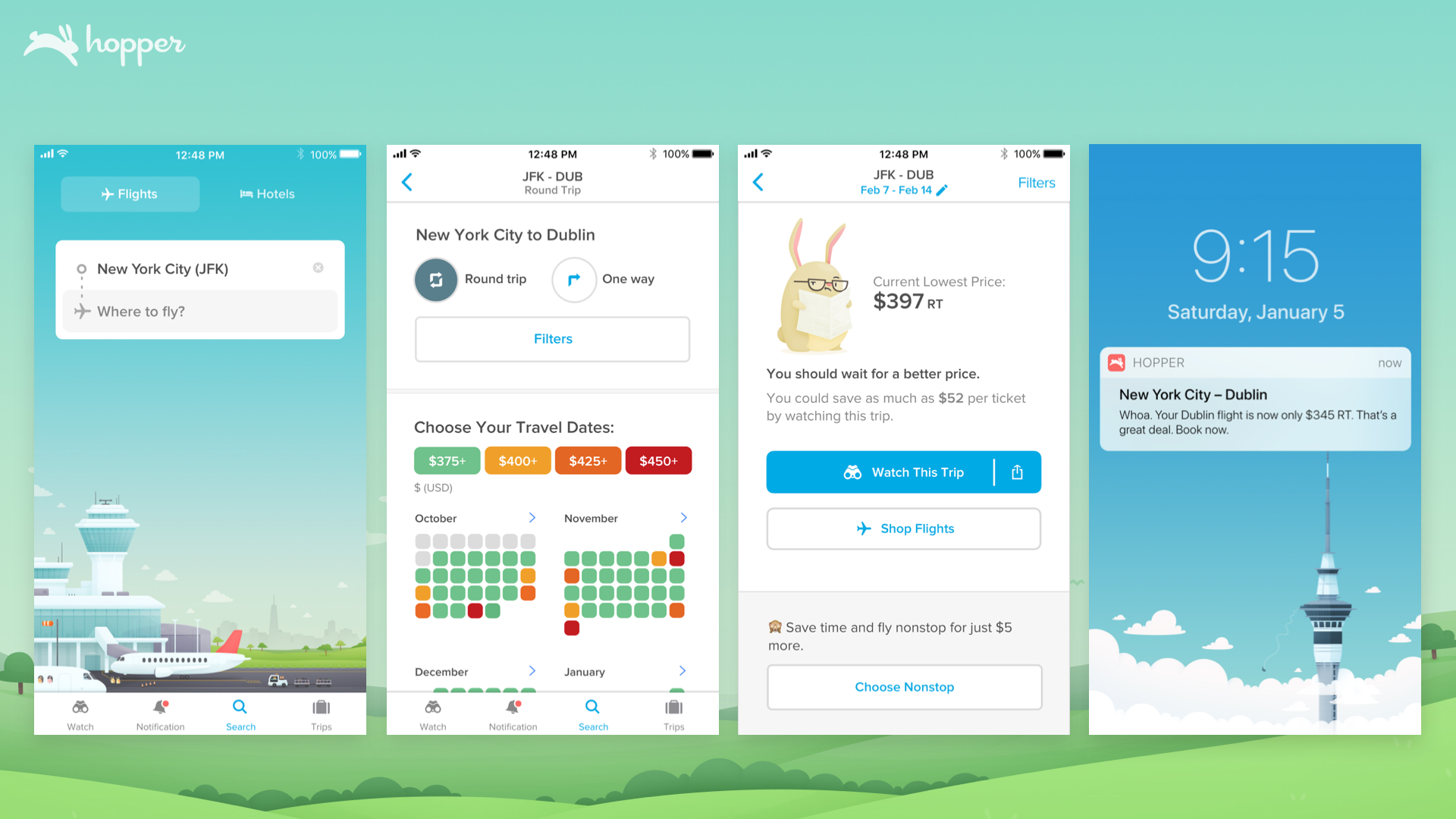

Picture Credits: Hopper

“What is fascinating is as need has recovered, at first we thought due to the fact we had quite, incredibly substantial attach charges, we imagined all those would never come back again,” he reported. “But we’ve really outgrown our pandemic attach amount. So people are incorporating far more of these solutions, and we credit that to the solution innovation.”

Lalonde also credits the pandemic for proving out the validity of its fintech method, due to the fact Hopper “had a lot of liabilities” in location prior to the world wide shutdowns, and so a large amount of investors and observers ended up looking at and considering that however this was a novel and interesting strategy, carrying people liabilities appeared to incur a ton of additional chance, as well. The pandemic was “the mother of all black swan occasions,” nonetheless, he notes, which means that now, it does not have to speak about the theoretical resilience of its design — it can stage to the genuine practical experience.

“Three months later, [it turns out] we lost dollars for about 30 days,” Lalonde explained. “Now we’re again on the other side of this, each and every color is financially rewarding. The actuality is the way that the future journey credits kicked in, and how the refunding function, we ended up with a really stable profits stream.”

Hopper buyers may possibly not have felt so optimistic about the company’s general performance for the duration of the pandemic, even so. The startup’s application opinions, Better Business Bureau (BBB) profile and social media accounts had been inundated with detrimental reviews and stories of lousy ordeals. Most centered all-around either a deficiency of buyer means to safe their refund, or a failure of communication on Hopper’s element. Lalonde claims that Hopper definitely unsuccessful at the conversation element, and it is nevertheless in the process of employing hundreds of more connect with middle staff to improve that component of the small business, but basically, it opted to just take a hit on that front in get to concentrate on building a complex option to handle the unprecedented volume of flight credits coming from airways.

“The part that is misunderstood is that all of a unexpected, the airlines gave out these future vacation credits,” he claimed. “These vouchers, we experienced to crucial them in all by hand. And I swear, this is a inexperienced monitor – you have to go in and do commands. It normally takes about 20 minutes to do one particular, so we counted how significantly time with all of our personnel, it would just take us to do them by hand. And the remedy was we’d be performed in 2070, and then even if you double the range of folks undertaking it, it was 2050.”

No present automation for this procedure existed since prior to the pandemic, credits for non-refundable airline tickets just did not actually exist, and notably not at scale. At that issue, Lalonde states Hopper “made a choice to place most people on the automation, [and] just get murdered publicly.”

He suggests that gamble has labored out, considering the fact that the moment the automation was up and running, they’ve been capable to apparent out the backlog pretty a lot completely. And the corporation has also been focused on new product or service developments, including shifting its roadmap to prioritize the addition of vehicle rental and hotel/vacation house scheduling to better match the desires of pandemic travel, which has mostly been overland in North The usa. That has intended deprioritizing other locations, which includes international growth, but Lalonde says that’s one target for use of the new resources the company raised.

The other massive emphasis is Hopper Cloud, a B2B providing that presents the advantages of Hopper’s machine-understanding electric power value prediction, as perfectly as its fintech travel insurance policies and disruption prevention goods, but tied to a different businesses’ one of a kind offerings. In the circumstance of Funds 1, that implies all the benefits the organization provides its cardholders in phrases of earning and redeeming travel credits, for instance. I requested Lalonde whether that strategy was built far more appealing by the simple fact that it fairly intermediates the customer practical experience, but he pointed out that the initiative is a co-branded one particular, so Hopper still has its identify on the product or service and the accountability. Plus, he additional, the true benefit of these forms of partnerships are the community outcomes, and Hopper’s intention stays becoming the top rated reserving place for clients immediately.

“One of the reasons I in no way want to drop the market — it’s increasing actually rapidly and creating revenue, but even if it didn’t, shedding that would just set us further more away from the conclusion buyer,” Lalonde stated. “I like the proximity of understanding particularly what transpires, and sensation the agony when we screw up and emotion the pleasure when we get a little something correct.”