Cindy Baker thought she understood how to use Venmo. She didn’t. Her confusion about the money transfer app led her to send $1,300 from her bank account directly to a virtual stranger. And that person refuses to return it. (Reprint)

Now she is asking the Elliott Advocacy team for help.

Baker’s expensive lesson on how to use Venmo safely is one that anyone considering using a money transfer app should read. Although Venmo is a convenient way to send funds to friends and family, there are dangers involved. That is to say; the system is much like a wire transfer — once you hit send, your cash is gone. And retrieving it can be impossible.

Make sure you know how to use Venmo

Baker was planning a girls’ weekend to Las Vegas for herself and her daughters. She needed two rooms for two nights. Looking for economical options, she turned to Vegas Hotel Escapes, a site that a casual acquaintance recommended.

“I was working directly with Byron Copeland,” Baker recalled. “He identified himself as the owner of the company. He was very helpful and gave me a variety of options that would work for us.”

Baker says that she settled on the MGM Grand for their getaway. Copeland then told her that he would need payment in full. Baker said Copeland told her to send $1,300 directly to his personal Venmo account.

Some alarm bells should have gone off for Baker at that moment. But none did. A travel agency should not request payment through a personal Venmo account. More on that shortly.

Having never heard of it before, Baker did not know how to use Venmo. She asked Copeland if he could accept a credit card over the phone. She says that he told her that he preferred Venmo. So she went to the Venmo site. Acquainting herself with the general terms, she registered and connected her bank account to her newly minted Venmo account. It seemed simple enough.

Taking a gamble on Venmo — and Vegas Hotel Escapes

“I sent Byron $1,300 from my Venmo account to his account,” Baker explained. “It was very easy. He received the money immediately. And a few days later, he sent me the hotel voucher. I noticed no mention of the early check-in Byron had promised. But he assured me that everything was in order.”

However the day before her trip, Baker found out everything wasn’t in order.

She called the MGM reservations department directly to confirm her early check-in. And that’s when she received the startling news that she had no reservation at all.

Baker contacted Copeland again via text and asked him what was going on with her prepaid reservation.

“I’m on the phone with the hotel and the wholesaler right now,” he answered. “For some odd reason, your reservation is showing as canceled.”

Although Copeland told Baker that he would figure it out and get her reservation reinstated, Baker declined. She was about to leave for Las Vegas and didn’t want to take a chance of arriving in Sin City without a room. She wasn’t feeling confident about Copeland or Venmo now and she just wanted a refund.

Copeland quickly agreed to return her $1,300 and Baker made a new reservation directly with MGM.

Baker and her crew headed to Las Vegas assuming this mishap was behind her. It wasn’t.

Her problem with Vegas Hotel Escapes and Copeland had only just begun.

Checking Venmo. Where is that $1,300 refund?

Knowing that Venmo provides an instantaneous money transfer, Baker repeatedly checked her account that day for the promised refund. When the entire day went by without any alert from Venmo, she began to get a sinking feeling.

“I texted Byron 20 times that day asking why he hadn’t sent my money back,” Baker reported. “He stopped responding, so I called him.”

She says Copeland answered the phone and told her that he would need one week to return the money.

“At that time, Byron told me that he couldn’t give me the money back until the wholesaler returned it to him,” Baker remembered. “That made sense to me. At that time he was blaming the entire problem on the wholesaler.”

Baker completed her trip to Las Vegas and continued to anxiously await her $1,300 refund. She waited ten days before she began hammering Copeland with texts.

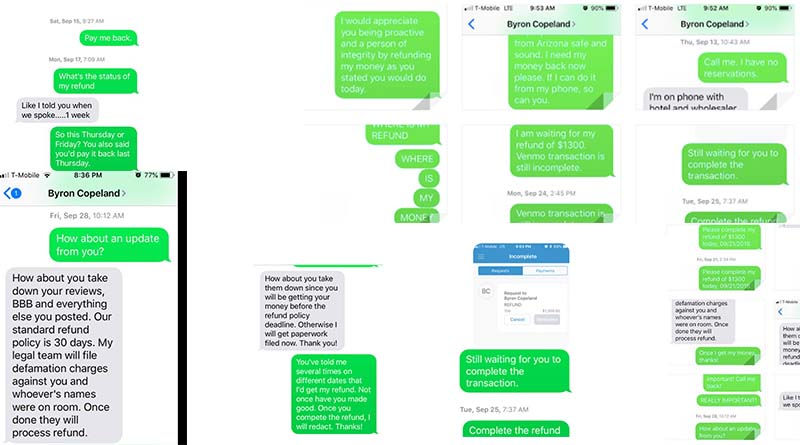

“Give me my money back,” Baker demanded. “Where. Is. My. Refund?! I’m waiting for you to send my money back through Venmo!”

Copeland continued to tell Baker that he had not received the money back from the wholesaler yet. These interactions are memorialized in a plethora of texts between the two.

So Baker decided to contact the wholesaler directly to find out why it hadn’t returned her money.

The wholesaler will not be sending a refund

When Baker contacted Restel, a hotel reservation center located in Spain, she got more bad news about Vegas Hotel Escapes. She asked the company why it had not returned her money.

Dear Mrs. Baker,

Both reservations are canceled in our system. You have to contact the agency to ask them for this refund. Vegas Hotel Scapes[sic], never paid us for these reservations, so obviously, we have not been able to refund anything.

Sorry, but I can’t help you since we have not invoiced anything for these reservations.

Stunned by this news, Baker realized that her $1,300 was in great jeopardy. And now she finally settled in to read all the terms and conditions of Venmo — something she should have done before using the service.

Never send money to strangers with a money transfer app tied to your bank account

Venmo is a mobile money transfer app offered by Paypal. And is advertised as a way to:

Pay friends and family with a Venmo account using money you have in Venmo, or link your bank account or debit card quickly.

If you’re a regular reader of our site, that last part about funding through a bank account or debit card probably is alarming. It should be.

Spend any time perusing our library of consumer battles and you will invariably come across a person whose problem was compounded by their use of a debit card. (For example: How to get a smoking fee reversed? Like this and Warning: Don’t use a debit card to buy a minipig.)

The Fair Credit Billing Act protects consumers who use their credit cards to make payments to merchants. If a merchant does not provide the goods or services as agreed upon, you’ll get your money back. Unfortunately, if you use your debit card or direct withdrawal from your bank account, you’re not protected. Baker had funded her Venmo account directly from her bank account. No credit card was involved. And so that avenue for help was already blocked.

Unfortunately, this is not how to use Venmo

But in Baker’s case, the funding source of the payment wasn’t the only reason that this transaction had no protection. Copeland’s personal Venmo account is not an approved merchant account. The transfer was considered a peer-to-peer money transfer.

Since Baker’s Venmo account was tied directly to her bank account, the funds were transferred directly from her bank to Copeland’s bank. Just like a wire transfer. And a bank cannot reverse these types of transactions once they are complete.

Baker pleaded with Venmo for help. Although the representatives were sympathetic, they all pointed out that she had not used the Venmo service in the way it was intended. She had violated the terms and conditions by sending money to a stranger for goods or services.

Venmo explains what went wrong

In its response to Baker, a Venmo Accounts specialist explained:

It appears that person you were transacting with did not fulfill their end of the transaction.

At this point, Venmo does not allow peer to peer merchant-related transactions. We do not offer any buyer or seller protections in these types of cases. These violations of our User Agreement are very high risk and can result in problems for our users.

Please remember that Venmo is a simple way for friends and people who trust each other to send money. It is not designed for uses beyond this purpose. When transacting with people whom you don’t know or trust there is always the potential for problems to arise.

When Copeland had asked Baker to send the money via Venmo, it had seemed innocuous. Although she had never met him personally, she says he was friendly and seemed very interested in helping her arrange the perfect getaway with her daughters. But now his request to pay via Venmo seemed sinister to Baker. She realized she should have questioned the unusual form of payment that she didn’t understand. And the full impact of this mistake suddenly hit her full force.

And that’s when she tried her last resource the Elliott Advocacy team.

Why won’t Vegas Hotel Escapes send Baker her refund?

When Baker sent her long, disturbing paper trail to me, she was desperate. And I also was unfamiliar with all the terms of Venmo. I hoped that there was some way to reverse this transaction. I read through all of Venmo’s conditions of use, and it soon became clear: there wasn’t.

Venmo is not meant to send payment to strangers for things that a consumer wants to purchase. And sending $1,300 to a stranger for two hotel rooms in Las Vegas is not an approved Venmo use.

In a final comment about Baker’s case to her, a Venmo specialist warned:

The moment you send a payment to an active Venmo user, the funds are made available to them. There isn’t a way for us to stop the debit being made from your funding source once you’ve sent a payment to another user.

And for that reason, Venmo is only intended for users to transfer money to friends and family. It is not meant to use with strangers.

Be careful about posting negative reviews too soon

Baker had made many public accusations and complaints about Copeland rather early in her attempts to get her money back. We never recommend this tactic. If you’re hoping to resolve a problem with anyone, it’s essential to keep your interactions concise and pleasant.

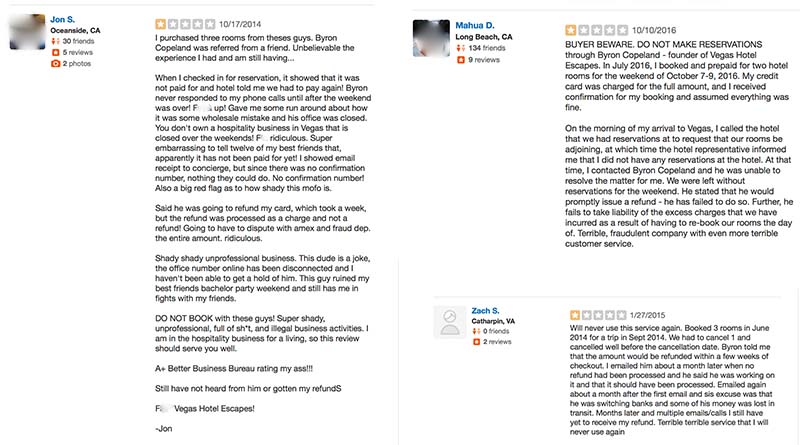

These publicly posted reviews of Copeland and Vegas Hotel Escapes on Yelp, Facebook and BBB escalated the negative feelings between Copeland and Baker. In one text Copeland warns that unless Baker takes down her accusations, she won’t receive any refund.

“How about you take down those reviews since you will be getting your money before our refund policy deadline,” Copeland demanded. “Otherwise I’m going to file defamation charges against you.”

Baker says she was never provided any information about a 30-day refund policy.

It is interesting to note that there are several other similar complaints about Vegas Hotel Escapes (and Byron) on Yelp. And the agency receives an F on the BBB for failing to respond to complaints.

Contacting Vegas Hotel Escapes and Venmo

I sent Copeland an email at Vegas Hotel Escapes. It had been six weeks since this hotel fiasco began. I asked Copeland if the refund was merely an oversight and told him that I would be writing an article about Baker’s struggle. I explained that I hoped to have a positive ending to report. He did not respond. I sent two follow-up emails to Copeland’s email address and to Vegas Hotel Escapes.

Again, with no response.

I contacted Venmo for a statement about this case and to find out if there was any possible way to retrieve this money. A Venmo spokesman explained:

Venmo is designed for payments between friends and people who know and trust one other. Users should avoid payments to people they don’t personally know, especially if it involves a sale for goods and services (for example, concert tickets, electronic equipment, sneakers, a watch, or other merchandise). These payments are potentially high risk, and users could lose their money without getting what they paid for.

We have teams dedicated to fraud prevention, support, and operations working tirelessly behind the scenes. Specifically, we use bank grade security systems and data encryption. We also use multifactor authentication when using new devices and email notifications, should passwords be changed.

To be continued…

Unfortunately, as I suspected, Venmo can’t provide a positive resolution for Baker.

And now it has been ten weeks since Copeland first promised a refund to Baker. She is busy preparing a small claims lawsuit against Copeland. He is no longer responding to Baker, and this appears to be her only possible recourse.

I sent one more request for comment to Copeland this week. I warned that I would only be able to report Baker’s rendition of her experience if he did not respond. He did not. And we continue to welcome his explanation as to what happened here and why Baker’s money is still in his possession.

Remember when you send money via a wire transfer or a money transfer app such as Venmo or Chase’s QuickPay, make sure you understand the service. If you don’t, you might be taking a gamble that you just can’t win.

Nevada Consumer Affairs visits Vegas Hotel Escapes

Two days after we published this article in November 2018, the chief investigator from Nevada Consumer Affairs (NCA) visited the physical location of Vegas Hotel Escapes concerning Baker’s complaint. The investigator spoke with an employee of Vegas Hotel Escapes. In the NCA report that employee is not identified by name but promised to process the refund for Baker immediately. NCA required that the payment be made through its office.

One month later, when NCA had not received the payment, it sent a Final Demand notice to Vegas Hotel Escapes. As of this week, Vegas Hotel Escapes has not returned Baker’s $1,300.

Although Baker has not received her money, there is a bit of good news as she sees it. Vegas Hotel Escapes is now dissolved. It is no longer licensed in Nevada and the website is dead.

“At least [Copeland] won’t be doing ‘business’ as that brand anymore,” she told me last week. And NCA is continuing its investigation.