Logo

The shares of Paycom Application (NYSE: PAYC) have missing 16% because the commencing of this 12 months inspite of ongoing vaccination allaying vacation fears and pushing the hospitality sector greater. For each latest earnings, the company’s administration has guided for a 20% income progress in 2021 – pretty in-line with the trajectory observed in the past few several years. Paycom sells human money management software program to businesses and generates a bulk of its revenues from payroll processing. The U.S. financial state has been observing advancement in employment studies given that the massive dip observed past February. Furthermore, Trefis thinks that soaring financial activity will benefit employment solutions firms as the labor participation charge increases and furloughed staff members return to get the job done. We emphasize the historical traits in revenues, earnings, and inventory rates in an interactive dashboard analysis on Get Or Panic Paycom Application Inventory?

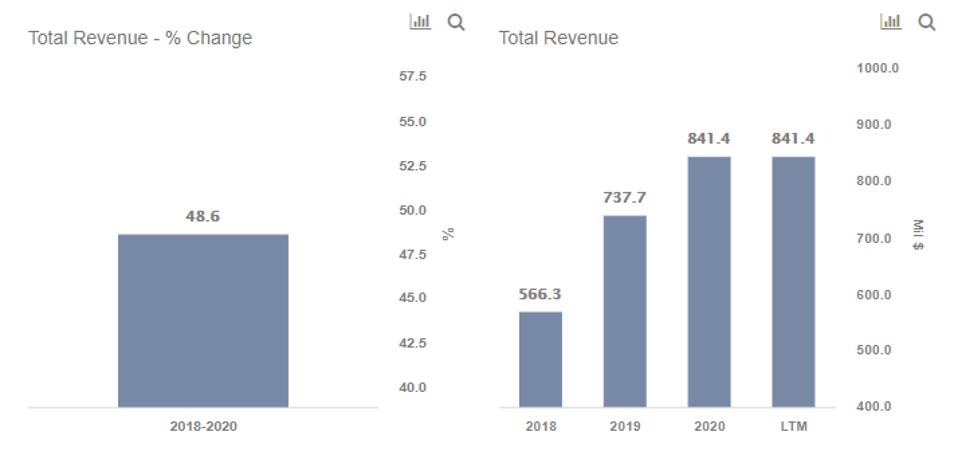

Paycom’s revenues have developed at an average amount of 25% per 12 months from $433 million in 2017 to $841 million in 2020, pushed by the acquisition of new clientele and growth of its product or service offerings from common HCM to integrated cloud-based mostly solutions. Notably, the company’s customer base elevated by 55% from 20,000 in 2017 to 31,000 in 2020.

Steady with higher earnings progress, internet profits also surged by 16% from $123 million in 2017 to $143 million in 2020 – foremost to a sizable get in the stock’s P/S many. Although the latest P/S several of 25 is considerably larger than prior several years – 18 in 2019 and 9.5 in 2018 – we consider that PAYC stock has a sizable upside as its top line is expanding at a considerably larger price than the market chief ADP. Our before analysis on ADP vs. Paycom: Is ADP Stock Properly Valued Specified Its decrease P/S Many Compared to Paycom? highlights the critical elements.

Broader Marketplace Outlook

In the latest launch, the Bureau of Labor Data documented that 379,000 careers were extra in February 2021. Evaluating to prior 12 months studies (before the pandemic), there are 9.5 million much less work opportunities in the U.S. financial system with hospitality, education, and general public sectors influenced the most. Notably, there are 3.5 million, 1.3 million, 1.4 million career losses in the hospitality, education, and community sectors, respectively – accounting for 65% of the total unemployment figures. Congress passed a $1.9 trillion relief and restoration package deal to increase work progress, but we believe that ongoing vaccination can outcome in a quicker than expected recovery in the hospitality field. For every the vaccine tracker by Bloomberg, it will choose 6 months to vaccinate 75% of the U.S. population with two-dose variants. Curiously, the shares of Southwest Airways (NYSE: LUV) and JetBlue Airways (NASDAQ: JBLU) have wholly recovered to pre-Covid concentrations supported by TSA checkpoint figures.

The coronavirus pandemic has made numerous pricing discontinuities which can provide attractive trading alternatives. For illustration, you’ll be surprised how the stock valuation for Microsoft vs. Vertex Pharmaceuticals displays a disconnect with their relative operational progress. You can obtain several these discontinuous pairs right here.

See all Trefis Price Estimates and Download Trefis Details here

What’s at the rear of Trefis? See How It is Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Merchandise, R&D, and Promoting Groups