Bonds backed by America’s airports are rallying again as the Covid vaccine rollout guarantees to revive the vacation sector, marking a rebound for one particular of the corners of the municipal-financial debt industry toughest strike by the pandemic.

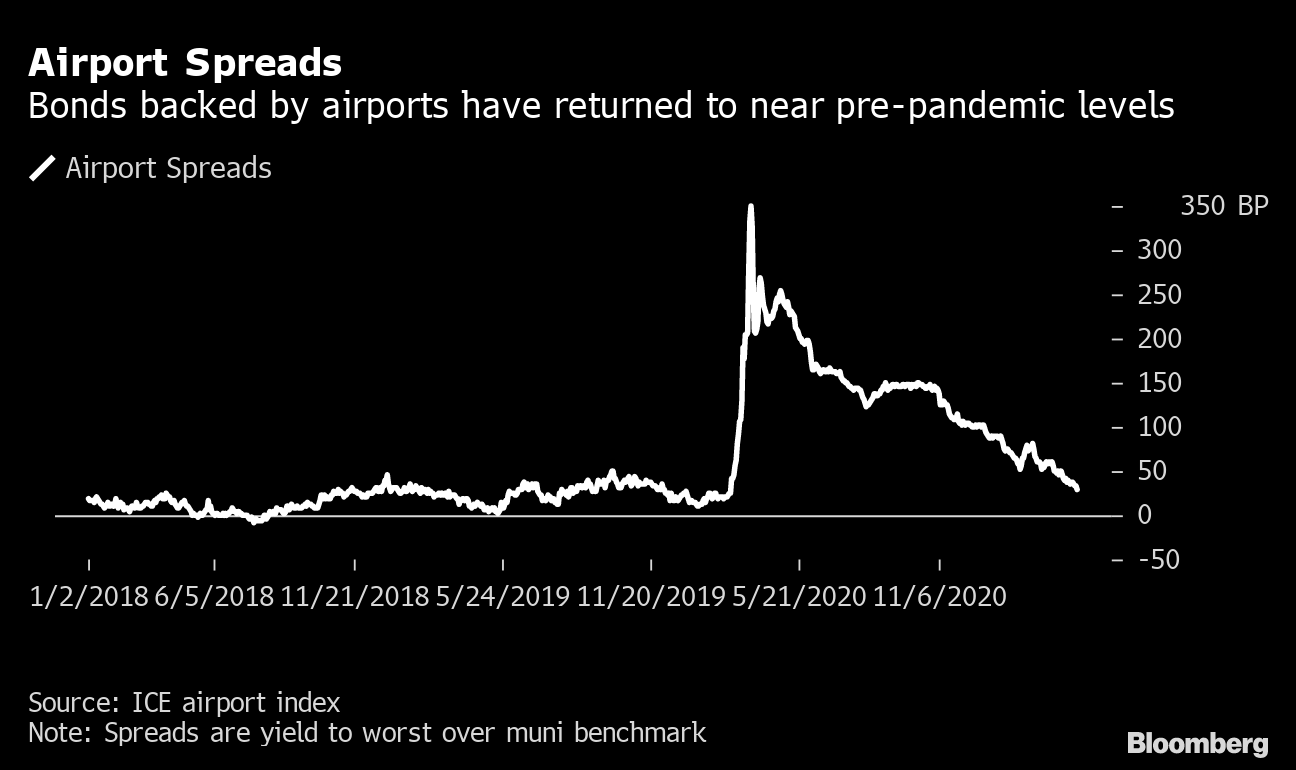

The rally has pushed the yields on debt backed by airports down to about 1.2%, or about 30 basis details far more than the market’s benchmark, in accordance to an ICE Lender of America index tracking the sector. That marks a extraordinary shift from early in the pandemic, when speculation about the deep economic toll of the nation’s shutdowns drove the index’s produce to a lot more than 4% as investors dumped the securities in droves.

The go eradicates what experienced been some of the exceptional bargains in the municipal securities market place as valuations on top-rated bonds hover in the vicinity of record highs. Junk bonds have climbed, as well, pushing the yields again towards the extra than two-decade low strike just before Covid-19 raced as a result of the U.S.

“During the pandemic, airways and anything connected received certainly crushed in phrases of spread — and they stayed wider for a more time interval of time than some of the other sectors that ended up impacted,” stated Jason Appleson, a portfolio manager at PT Asset Administration in Chicago. “In terms of purchasing prospect, I’m not guaranteed there is a large amount remaining.”

Airport Spreads

Bonds backed by airports have returned to near pre-pandemic amounts

Source: ICE airport index

Airline travel is exhibiting signals of restoration with more than a person-fourth of People absolutely vaccinated against the coronavirus. The amount of travellers for every working day reached a yearly large of 1.58 million in early April, about 68% of the normal in the course of the same month in 2019, in accordance to Transportation Safety Administration checkpoint travel knowledge.

That’s assisting to carry the bonds of some massive airports. The produce on 8-12 months personal debt issued by the Metropolitan Washington Airports Authority, which operates Reagan National and Dulles Global airports, has dropped to about 1% from as substantially as 1.43% in the middle of past month, according to facts compiled by Bloomberg. Those on very similar bonds backed by Orlando, Florida’s airport have dropped to about 1.2% from as a lot as 1.84% in mid-March.

Very last month, Moody’s Investors Provider lifted its outlook on U.S. airport financial debt to secure from unfavorable, citing more robust passenger stages and the impact of federal stimulus measures. Airports been given $8 billion in more funding from the American Rescue Strategy, on leading of the $12 billion allotted in 2020.

Dan Barton, head of municipal analysis at Mellon Investments Corp. explained that he likes the airport sector mainly because of the expectation of enhanced travel and the total of federal help the amenities obtained by way of a variety of stimulus bills.

“When you observed a sector that shed 99% of journey in the early element of the pandemic, and it was debatable how very long it would get to recuperate, it is not surprising that airports was a single of the slowest sectors to recuperate,” Barton mentioned. “But it has arrive back again extremely solid.”

BlackRock Inc. analysts led by Peter Hayes explained in a notice this month that the enterprise is protecting a desire for sectors that have been additional afflicted by the pandemic, noting vacation-linked industries like motels and airports.

However there are however some headwinds, with it nevertheless unclear how substantially function-associated travel will rebound soon after a extended run of organizations discovering to do without the need of it. “The biggest obstacle is heading to be the return of enterprise vacation in a meaningful way,” stated Eric Kazatsky, senior U.S. municipals strategist for Bloomberg Intelligence.

— With assistance by Danielle Moran