UKRAINE – 2021/03/07: In this picture illustration a Boeing emblem is viewed on a smartphone and a pc … [+]

[Updated 4/1/2021]

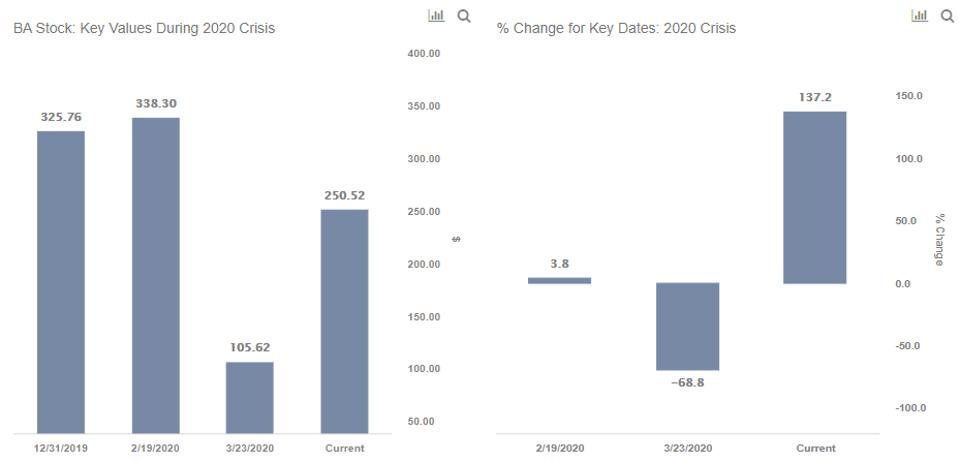

In January, Boeing (NYSE: BA) entered into a $2.5 billion settlement with the U.S. Division of Justice ending the two-12 months investigation on the 737 Max plan. For every the settlement, Boeing is essential to shell out a $243 million penalty, $500 million compensation to the kin of folks who shed their lives in MAX crashes, and $1.77 billion to airline buyers. Notably, the enterprise presently has a $5.5 billion shorter-term legal responsibility similar to shopper concessions on its harmony sheet. Although the current lawsuit by investors is a concern, the company’s ballooning personal debt is generally from superior inventory levels. Additionally, Southwest’s 100 aircraft get reinstates confidence in MAX immediately after the FAA’s clearance. As air vacation demand picks-up, the reduction of Boeing’s 400+ plane inventory is the vital result in for a sizable upside in the stock. Our interactive dashboard analysis highlights Boeing’s inventory functionality throughout the latest disaster with that during the 2008 economic downturn.

Inventory % Adjust

[Updated 3/11/2021]

The shares of Southwest Airlines (NYSE: LUV) have rallied 20% in the past 21-days achieving their pre-Covid stage, propelled by the second spherical of payroll aid by the U.S. government and an maximize in passenger figures at TSA checkpoints. Curiously, Southwest is a well known Boeing 737 MAX buyer with a complete of 380 plane to be sent in the subsequent couple of a long time. Regardless of the lifting of the FAA’s ban in November 2020, the shares of Boeing (NYSE: BA) keep on being all around 30% below pre-Covid concentrations. When the FAA’s purchase requires style improvements and revamp of pilot and crew training programs to properly fly yet again, the company’s ballooning personal debt thanks to higher stock ranges is expected to relieve with aircraft deliveries. Trefis compares the historic inventory selling price trends in between Boeing and its outstanding MAX buyers in an interactive dashboard examination, BA Inventory Has 50% Chance Of A Increase More than The Subsequent Thirty day period Right after Mounting 4.3% In The Previous 5 Days.

Airline stocks have outperformed broader markets this calendar year but Boeing has not

In a not long ago posted vacation outlook by Expedia, air journey is expected to increase later on through the 12 months with young inhabitants (Millennials and Gen Z) traveling the most. About the earlier 21 days, Southwest Airlines, United Airways, and American Airlines’ shares have gained 20%, 27%, and 25%, respectively. On the opposite, Boeing stock has elevated by 12%, 10%, and 4% above the 20 just one-day, ten-working day, and 5-day time period respectively. Per Boeing’s professional market place outlook, world wide passenger traffic and plane fleet are envisioned to develop annually by 4% and 3.2% in the future twenty a long time, respectively. Also, new plane demand from customers will generally be pushed by more mature aircraft replacements, practically 56% of new deliveries, in the coming ten years.

YTD General performance

Boeing’s credit card debt is owing to higher stock stages

Boeing’s extended-time period credit card debt soared from $10 billion in 2018 to $62 billion in 2020, due to piled-up 737 MAX inventories and funds raises to deal with any adverse pandemic state of affairs. The company’s inventories noticed a $20 billion soar from $62.5 billion in 2018 to $82 billion in 2020. As the harmony sheet holds $25 billion of money and limited-term investments, a key portion of the long-term personal debt is due to large inventory ranges.

When the 737 MAX generation is anticipated to resume afterwards this year, the 450 planes in the warehouse are very likely to satisfy near-term consumer desire and deliver dollars move. Also, Boeing reported just $7.5 billion of running funds outflow (excluding the influence of an $11 billion increase in inventories) in 2020, which is substantially reduce than the $55 billion fall in the stock’s market place capitalization. Consequently, the resumption of MAX creation is the key induce for a sizable upside in Boeing inventory from current amounts.

As the slump in journey demand from customers proceeds to weigh on the aviation sector, 2020 has produced a lot of pricing discontinuities which can offer you beautiful investing alternatives. For instance, you will be amazed how the inventory valuation for Expeditors International vs. LGI Houses demonstrates a disconnect with their relative operational progress. You can locate several this sort of discontinuous pairs listed here.

See all Trefis Price tag Estimates and Download Trefis Info here

What is driving Trefis? See How It is Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Item, R&D, and Internet marketing Groups