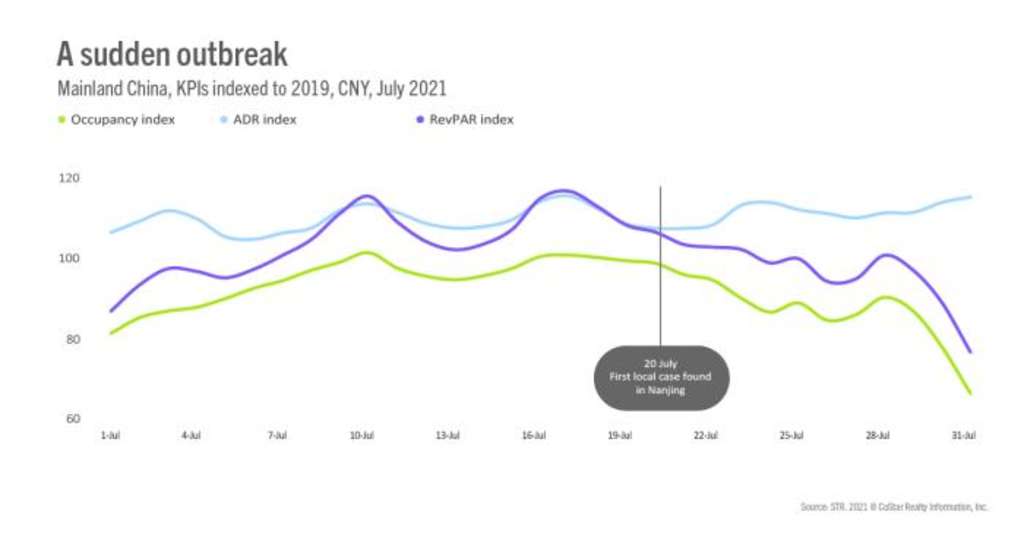

With the assist of summer season vacation, Mainland China’s general lodge occupancy price showed a excellent upward pattern in July, with the 2nd and 3rd week of the thirty day period achieving 2019 amounts.

Having said that, with confirmed COVID-19 cases in Nanjing on 20 July, momentum shifted abruptly. The existing outbreak has spread to several provinces and towns across the country, ensuing in show cancellations and conferences postponements. The out-of-the-metropolis initiative has put the lodge industry, which experienced been wanting forward to this summer’s summer time family vacation, back again into a wintertime-variety scenario and significantly shortened summer time holiday year.

Image: STR

As such, nationwide occupancy and RevPAR have revealed a certain downward pattern due to the fact 20 July. At the finish of the month, thanks to the spread of the pandemic, some provinces and towns have regularly claimed new nearby situations, and hotel effectiveness has dropped sharply with occupancy at only 60% of the comparable period of time in 2019.

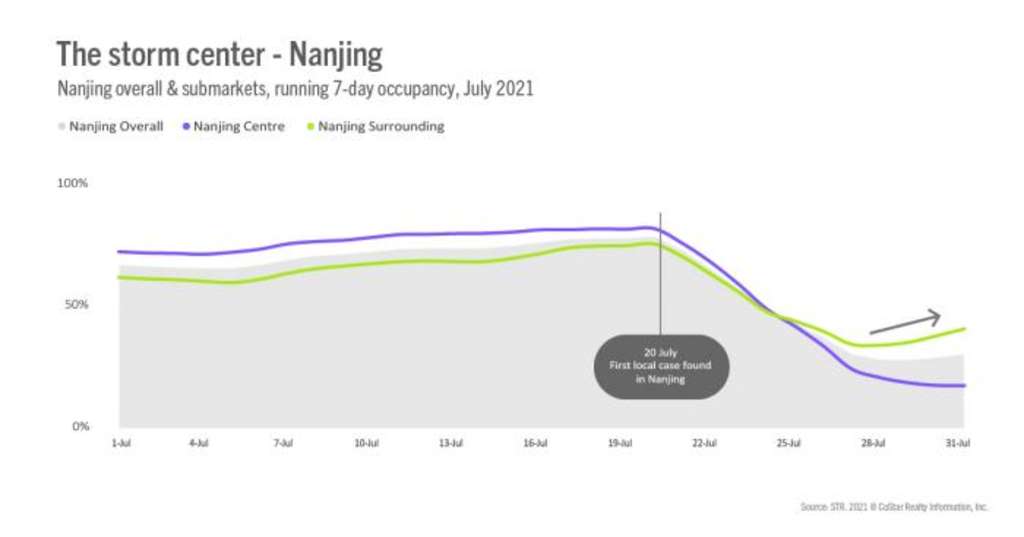

Nanjing deep dive

As the epicenter of this most current outbreak, Nanjing’s lodge market efficiency has been strike tough. After circumstances were described on 20 July, Nanjing’s over-all occupancy fell sharply around the upcoming 7 times, dropping promptly from a peak of 78% to a trough of 28%. The city centre current market, specifically, bottomed out at 17% on the final day of July.

Despite the fact that the market place all over Nanjing also experienced a sharp decrease on 25 July, the submarket, on the other hand, showed a compact improve at the stop of the thirty day period achieving ranges of more than 40%. It is considered that the primary motive for that better degree is that some bordering accommodations have been temporarily requisitioned as quarantine accommodations.

Picture: STR

Pick out current market overall performance

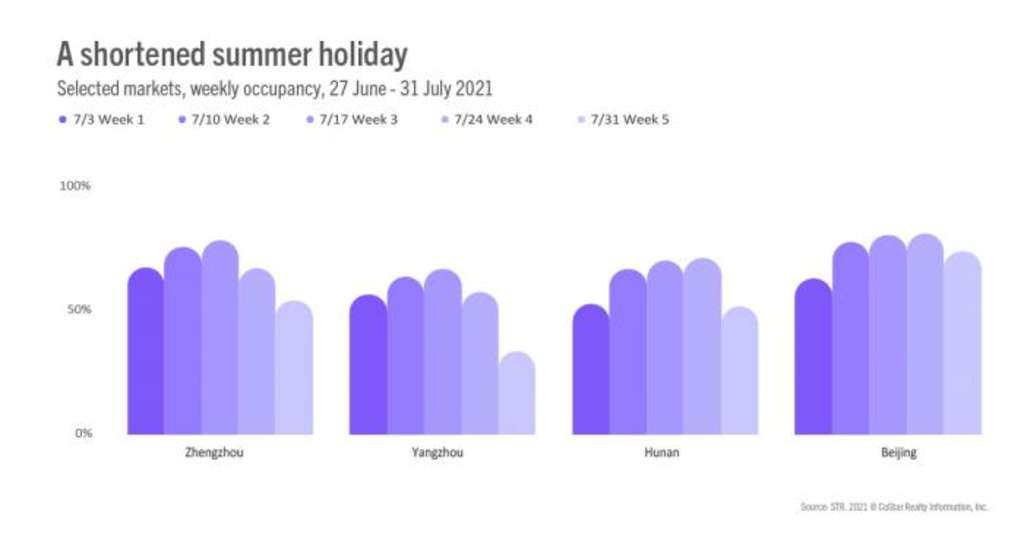

In the past 5 weeks, Mainland China has revealed a pattern of up and then down. Occupancy peaked in the third week or fourth 7 days of July and then fell to different degrees.

On 20 July, the Hunan Province was hit by major rains, with major flooding in Zhengzhou. Occupancy fell from practically 80% in the week ending with 17 July to 50% in the week ending with 31 July, with a reduction of virtually 30%. In addition to the existing emergence of local circumstances in Zhengzhou, the scenario is even worse.

Yangzhou, the 2nd-worst city to be afflicted by the latest outbreak, noticed a 33% occupancy rate for the 7 days ending 31 July.

Hunan Province’s occupancy rate, influenced by the local outbreak in Zhangjiajie, fell by 20% in the past week of the thirty day period.

Beijing is a summer time market, with occupancy rates exceeding 80% in the third and fourth months of July. But with the distribute of this outbreak, the last 7 days of the thirty day period showed a downward craze. Sporadic verified situations of associated instances no doubt solid a shadow on the marketplace.

Photo: STR

Guangdong the latest functionality

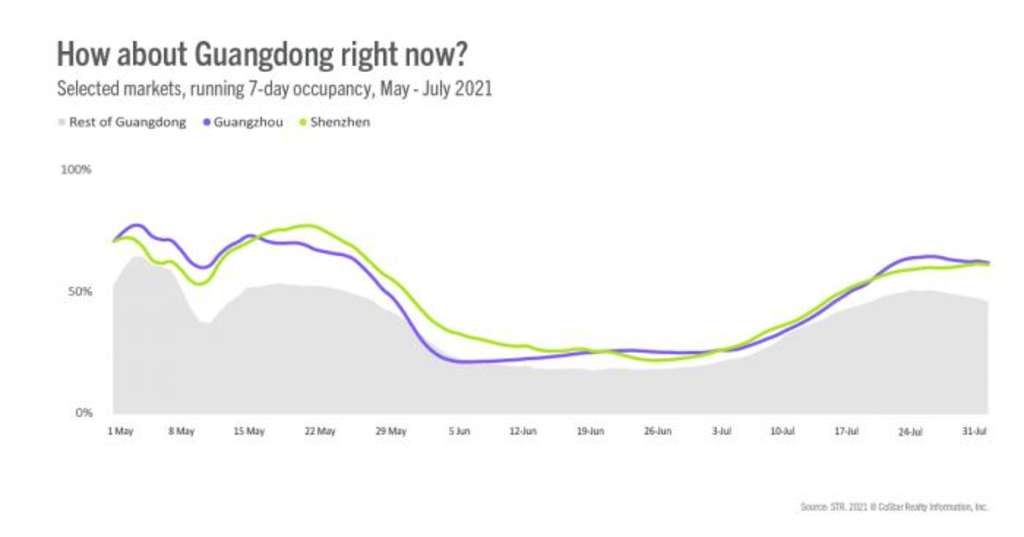

About the earlier a few months, Guangdong’s occupancy rate has been on a rollercoaster. The Labor Day holiday rushed to a significant place, then fell, and then speedily recovered, although Shenzhen occupancy was as high as 77%. Having said that, due to the emergence of the outbreak in Guangzhou, the market’s occupancy fell off a cliff, dropping to as small as 20%.

Immediately after a complete thirty day period of decreases in June, July started to clearly show a gradual climb, with finish-of-month occupancy at 60%. While the the latest domestic outbreak situation is major, Guangdong hotel industry has shown resilience.

Photo: STR

About STR

STR provides high quality info benchmarking, analytics and marketplace insights for global hospitality sectors. Started in 1985, STR maintains a presence in 15 nations around the world with a corporate North American headquarters in Hendersonville, Tennessee, an global headquarters in London, and an Asia Pacific headquarters in Singapore. STR was obtained in October 2019 by CoStar Team, Inc. (NASDAQ: CSGP), the main supplier of commercial real estate details, analytics and on the net marketplaces. For a lot more info, you should visit str.com and costargroup.com.