As dynamic travellers evolve, their changing behaviours and preferences are having very real impacts on the hoteliers seeking to attract and engage them.

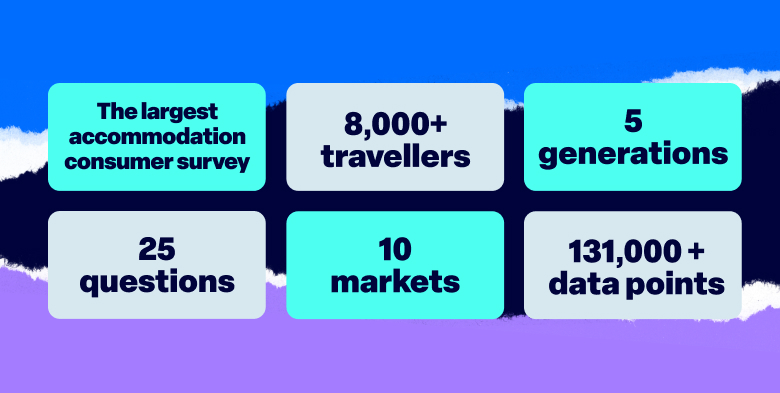

That was the key message from SiteMinder’s recent Changing Traveller Report, the world’s largest accommodation consumer survey, highlighting the major traveller trends transforming the world of accommodation.

I recently had the pleasure of sharing these insights at the The Hotel & Resort Innovation Expo, where I met with a range of existing partners and new faces bringing hotel experiences to life at this vibrant time in travel.

But what do SiteMinder’s global traveller trends mean specifically for hotel groups and chains, and how have the needs of their guests evolved?

To answer this question, I took a deeper dive into our report data, uncovering the core differences between the travellers planning for their next stay to be at a hotel group or chain and the travellers planning for their next stay to be at another property type, i.e. a B&B, vacation rental, boutique hotel, camping site, motel or hostel. The results, and more information on each of the five key trends from SiteMinder’s report are below.

For access to the full Changing Traveller Report, as well as how hoteliers can respond to these trends, click here.

Trend 1: The urge to travel is a stronger force than rising inflation

From our traveller survey data, we saw that travel is ultimately proving priceless, despite rising costs of living. Hoteliers who capture the opportunity behind this ‘Macro-Travel Trend’ will be those who understand the mindsets of their guests and fuel them with the memorable stays they crave, while also driving incremental revenue.

How are travellers staying at hotel groups and chains different from the rest?

– Inflation is having less of an impact on their travel and accommodation decisions than other travellers. For 62% of those planning to stay at a hotel group or chain on their next trip, inflation is having a “moderate” or “no” impact, compared to 57% of travellers globally.

– They are more comfortable spending additional money beyond their room. Eighty-seven percent of those planning to stay at a hotel group or chain are comfortable spending additional money on site, compared to 85% of all travellers. Thirty-three percent are fine to spend more on a spa treatment, compared to the average of 28%, and 32% are happy to spend on an airport transfer compared to the average of 26%. On average, they are also more open to spending on breakfast, the mini bar, a room with a view, the size of their bed (and room), and the floor they are staying on.

– Travel is more closely connected to their happiness. Over 90% percent of those planning to stay at a hotel group or chain said they were happier when anticipating travel, compared to the global average of 87%.

Trend 2: Right now, travellers are the most winnable consumers on earth

Our ‘Digital Influence Trend’ showed that, in light of the disruptions of recent years, a renewed global wanderlust means travellers have never been more winnable. They are welcoming slick paid media campaigns and communication pre and post-stay, which is making the online marketplace even more competitive, right up until the point of check-in.

How are travellers staying at hotel groups and chains different from the rest?

– They are more open to being delivered ads online for suitable offers and deals. Eighty-three percent of travellers staying at a hotel group or chain are open to being delivered an appropriate accommodation advertisement, 5% higher than travellers staying at other accommodation types.

– They are happier being communicated with post-stay. Fifty-eight percent of travellers planning to stay at a hotel group or chain ‘often’ or ‘always’ appreciate it when their hotel continues building on the relationship, post-stay, up from 54% of all global travellers.

– They are more likely to book via an OTA or travel agent. Forty-two percent of those staying at a hotel group or chain plan to book via an OTA, compared to 37% of all travellers, while 12% plan to book via a travel agent, 2% more than the average.

Trend 3: Working travellers want the hotel of the future, today

This ‘Bleisure Trend’ may sound familiar, but aside from an increase in working-from-anywhere, what do working travellers really want from their next stay? Travellers told us that the extra hours they’re spending on site at a hotel are making the ‘little things’ feel bigger, pushing the hotel of the future to become more like an upgraded version of life at home.

How are travellers staying at hotel groups and chains different from the rest?

– They are less likely to be working, than those staying at boutique hotels. Thirty-eight percent of those staying at a boutique hotel plan to work on their next trip, compared with 35% of those staying at a hotel group or chain, highlighting the opportunity to better cater to this group.

– They have different needs to other working travellers. When booking accommodation to work from remotely, those planning for their next working stay to be at a hotel group or chain consider a property with a pool, free breakfast, wellness facilities and a purpose-built work area as more important than other travellers do.

Trend 4: Every digital touchpoint matters for the new trust-critical traveller

Our fourth global trend was the ‘Trust Trend’. Increasingly, as online consumers scam-proof their purchasing, travellers are taking every cue to establish trust wherever it can be found. And in this environment, it’s the accommodation businesses building confidence at every stage of their guest’s journey — from secure payments to quality content — that will overtake those in the market that are still taking trust for granted.

How are travellers staying at hotel groups and chains different from the rest?

– Effective technology use is more important to those staying at a hotel group or chain. Seventy-two percent of those planning for their next stay to be at a hotel group or chain are either ‘likely’ or ‘very likely’ to change their perception of a property that’s not using technology correctly, compared to 65% of all travellers.

– When on a property’s website, available packages and guest reviews are more important to them. While a secure booking process is the most important aspect of a property’s website for those staying at a hotel group or chain (as with other travellers), available packages and guest reviews are relatively more important to them.

– They are more likely to pay online. Globally, 52% of those staying at a hotel group or chain prefer to pay online, compared to 48.5% of all travellers.

Trend 5: Tech-enabled travellers are not willing to compromise on human connection

This ‘Human Connection Trend’ showed that, while travellers like the conveniences that technology can bring, the hotel experience remains deeply linked with meaningful human engagement and, increasingly, the ability for their property to act as a launchpad into the local community.

How are travellers staying at hotel groups and chains different from the rest?

– Staff and customer service are more important to them. Alongside a hotel’s loyalty program, a memorable on site experience and the property’s uniqueness, a hotel’s staff are seen as more important for those staying at a group or chain, compared to other travellers.

– They are more likely to want an automated check-in, but their clear preference is still to have staff members on site. Fifty-two percent of those staying at a hotel group or chain prefer a faster, automated check-in process, compared with 48% of all travellers, however 89% prefer for staff members to be on site.

– They are more likely to want their property to help them learn about the local culture and history. Eighty-eight percent of those planning to stay at a hotel group or chain would ‘likely’ or ‘definitely’ appreciate it if their property helped them to learn more about the culture and history of the location they are staying in, approximately 1.5% more than other travellers.

I hope that this data has enabled you a deeper insight into the evolving needs and preferences of your property’s customers, and importantly that our report results in actionable ways that can improve the end-to-end experience of your guests.

Thanks for a great event everyone.